EU bank plans may be poorly funded: ECB

BRUSSELS - Reuters

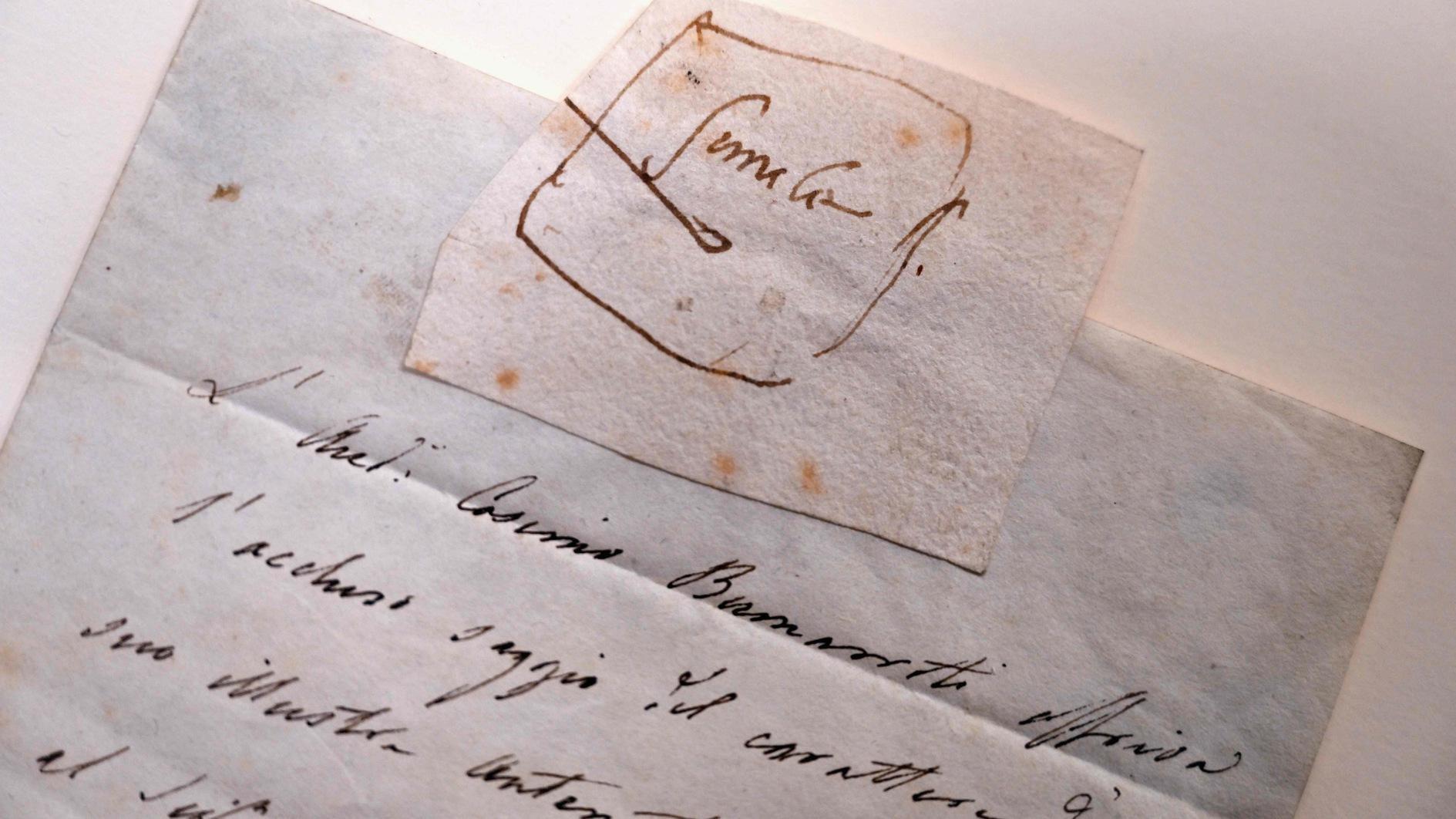

Mario Draghi, President of the European Central Bank (ECB) says they should not create a Single Resolution Mechanism that is single in name only. REUTERS photo

Europe’s latest plans for winding down failing banks may be too complex and inadequately funded, the head of the European Central Bank has said, as euro zone officials race to reach a deal on the thorny issue this week.EU finance ministers want to agree on a blueprint for dealing with failing euro zone lenders before a summit in Brussels on Dec. 19-20, to keep banking union plans on track and help restore confidence in banks after a four-year sovereign debt crisis.

But ECB President Mario Draghi questioned the strength of the plans that have emerged.

“I am concerned that decision-making may become overly complex and financing arrangements may not be adequate,” he told the European Parliament on Dec. 16.

Ministers and senior officials are set to meet daily this week to try to agree on what is called the Single Resolution Mechanism for winding down failing banks.

Deep divisions remain, especially over the Single Resolution Fund, the related joint fund that is meant to cover the remaining costs of any bank closures after shareholders, bond holders and even large depositors have been hit.

This fund is to be filled by annual bank contributions that will reach about 55 billion euros - but only after 10 years.

And while the point of banking union is to mutualise risk so that weak sovereigns are not left on their own to deal with troubled banking systems, Germany wants to minimise any liability of its banks or taxpayers for lenders elsewhere.

Berlin’s views are reflected in the latest EU plan, in which the cost of closing down a euro zone bank would initially be borne almost fully by its home country. The obligation of other euro zone countries will gradually rise until they are shared equitably - also only after 10 years.

The ECB made clear it did not like these ideas.

“We should not create a Single Resolution Mechanism that is single in name only,” Draghi said.

Complex compromise

EU policymakers have also devised a procedure in which it could days if not weeks to make a final decision on when to shut a bank, which Draghi said would be too slow.

“These things must be done instantly,” he said.

Due to disputes over who decides on bank closures, EU policymakers have drawn up a plan in which a Board of the Single Resolution Mechanism would prepare decisions on bank closures that the Commission would have the right to veto after consulting national authorities and the ECB.

The Commission would then tell the Board how the decision should be changed. The Board will have the right to question the Commission’s veto again.

Such a prolonged process could trigger bank runs in the case of a proposed bank closure.

“There is a point on non-viability, where the supervisor states that a certain institution is non-viable,” Draghi said.

“After that statement, any transaction that is being undertaken is potentially falling under the bankruptcy law and under criminal proceedings,” he said.

“One can’t have hundreds of people consulting each other on whether a certain bank is viable or not. So that’s my worry here, that the mechanism that will come out is actually a workable mechanism,” he said.

Equally contentious is the problem of how to backstop the Single Resolution Fund during the 10-year build-up phase and afterward.

Many policymakers want the euro zone bailout fund, the ESM, to be able to lend to the resolution fund in emergencies, arguing that euro zone taxpayers, the ultimate owners of the ESM, would

always get paid back

thanks to the power of the resolution fund to impose fees on banks.

Irish finance minister Michael Noonan told Reuters in an interview that only if backstopped by the bailout fund would the Single Resolution Fund be big enough to deal with problems.

“I think if it’s supported by an appropriate backstop it would be sufficient, but on its own it wouldn’t. Access to the ESM would be the backstop that would be appropriate,” Noonan said.