Eni, EU hold talks on row with Turkey

ISTANBUL- Hürriyet Daily News

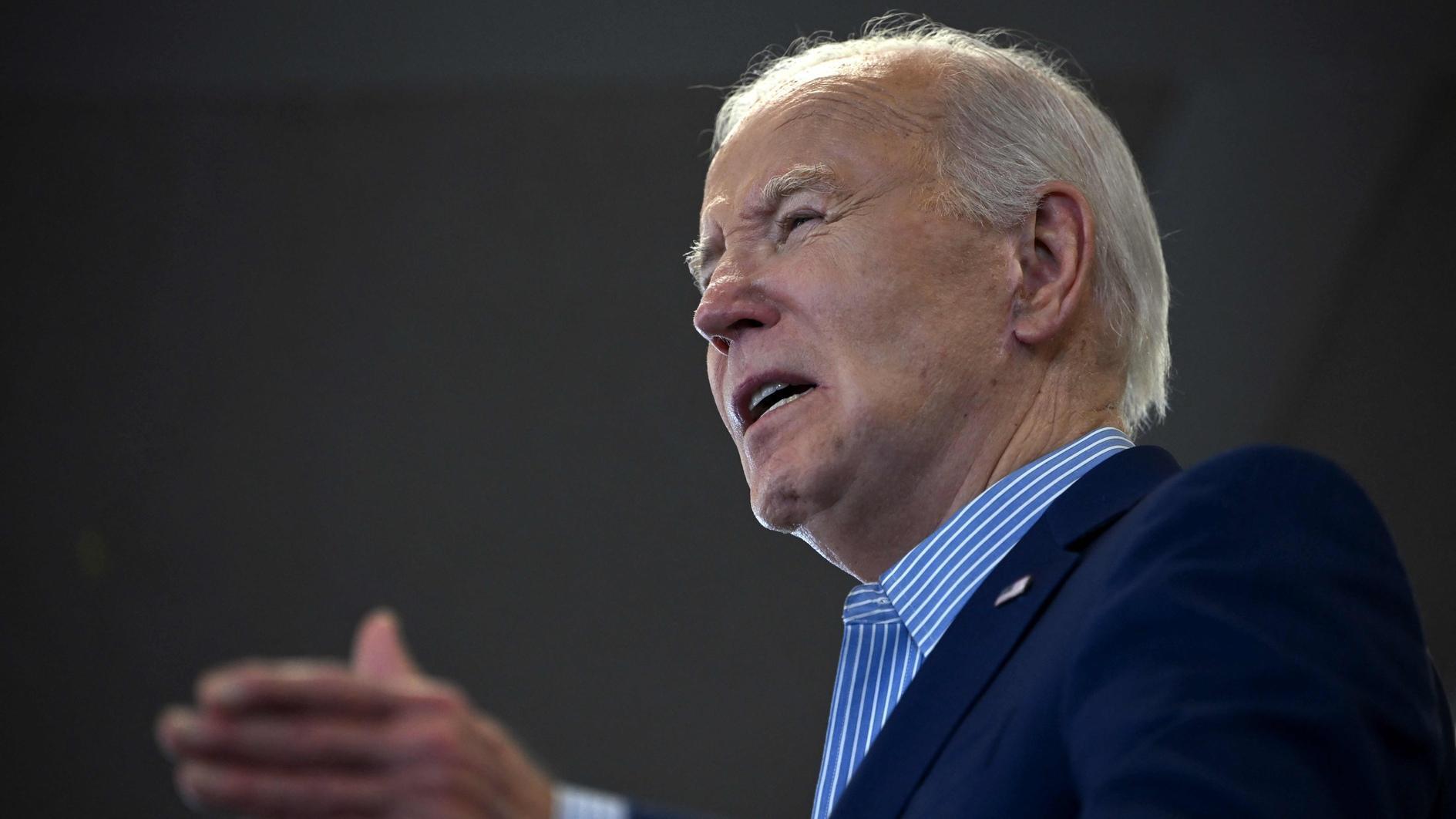

Eni is one of the partners in Blue Stream, the pipeline that carries the Russian natural gas to Turkey from underneath the Black Sea. Turkey says it may reconsider relations with the Italian firm. REUTERS photo

Italian energy company Eni has been in touch with the European Union as well as Rome concerning Turkey’s recent warning to review the Italian energy firm’s investments in the country if it goes ahead with plans to explore for natural gas in Greek Cyprus.“We are always doing what is legitimate according to EU law,” said Leonardi Bellodi, Eni’s senior vice president of public affairs.

Turkey has recently warned the company against exploring for natural gas off the coast of the divided island of Cyprus.

Turkish Energy Minister Taner Yıldız has warned that the government will review Eni’s investments in Turkey if it goes ahead with plans in Greek Cyprus.

Bellodi, who was in Istanbul yesterday to attend the Atlantic Council Energy and Economic Summit, said, “We are a corporation and we always act within state’s jurisdiction.” In response to questions on Turkey’s attitude, Bellodi described Turkey’s statement as a “mild reaction, raising the issue.”

“We are in touch with the European Union and with our government about this issue,” Bellodi said. “Eni is a corporation, and borders between states are not a matter that our company can decide. We will comply with any government agreement.”

Greek Cyprus approved licenses at the end of last month for the exploratory drilling of oil and gas deposits in four blocks off its shores, also announcing that it would negotiate a partnership with Eni, South Korea’s KOGAS, Italy’s Total and Russia’s Novatec.

Turkish reaction

Turkey is strongly opposed to the Greek Cypriot explorations in the Eastern Mediterranean, saying this violated the rights of Turkish Cypriots.

“Those companies cooperating with the [Greek Cyprus] will not be allowed to take part in new energy projects in Turkey,” the Turkish Foreign Ministry said in a statement Nov. 3.

However, Eni has been the only company mentioned in name by Turkish officials. Eni is also a partner to the Blue Stream, a transport system running beneath the Black Sea that supplies Russian natural gas to Turkey. With a transport capacity of 16 billion cubic meters annually, it is the main Russian natural gas link to Turkey and owned and operated by Blue Stream Pipeline Company BV (BSPC), a joint venture between Eni and Russian Gazprom.

Many projects will not see daylight: IEA

ISTANBUL – HDN

There were many natural gas pipeline projects in Turkey and the surrounding area, but many of them may not survive, according to Fatih Birol, the chief economist of The International Energy Agency (IEA).

“There are many projects today around Turkey, in Turkey, through Turkey. Looking at the demand, the situation in Europe, which is very weak, and looking at the development in the global gas market, I am not sure that most of these pipelines will see the light of day,” Birol told the Hürriyet Daily News in an interview yesterday.

“There will definitely be a cancellation of some of these projects,” he said, without naming any project name or route.

“It will be the economic viability and the political support for these projects that will determine that,” he said.

Earlier in the day, Birol said at an Atlantic Council meeting in Istanbul that any shale gas finding in Turkey would be a game changer, dropping natural gas prices. This might mark an end to oil-bound gas prices, he added.

Oil prices drop as weak demand offsets supply risks

LONDON – Agnece France-Presse

Crude oil prices dropped on Nov. 16 as a backdrop of weak energy demand offset potential supply risks caused by geopolitical tensions in the Middle East fuelled by Israeli air strikes in the Gaza Strip.

New York’s main contract, light sweet crude for delivery in December fell 36 cents to $85.09 a barrel.

Brent North Sea crude for January delivery dropped 18 cents to $107.83 in London midday deals.

“Crude prices are consolidating across the board as we close the week today, torn between the weak macro picture and supply risk premium from the Israeli/ Gaza tensions,” said Jack Pollard, analyst at Sucden brokerage.

“Seemingly... any sustained rally in prices is likely to be capped by its downside impact on demand whilst economic growth remains as is.” Prices were lower heading into the weekend after a mid-week bounce on the back of Middle East violence.