Egyptian pounds slides further following floatation

CAIRO - The Associated Press

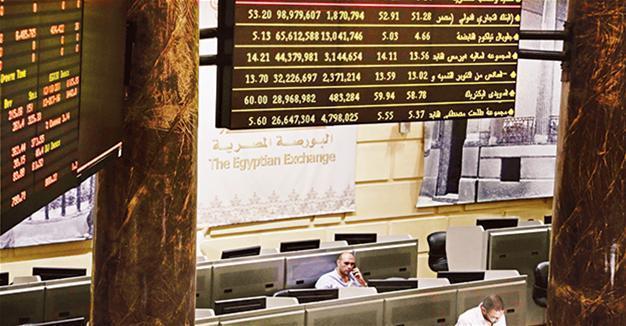

AP photo

The Egyptian pound is trading in banks at around 16 to the dollar, down from the 13-pound peg the Central Bank set as a guiding exchange rate when it floated the currency last week.Banks were selling the U.S. currency at 16 pounds while buying it at around 15.5 pounds on Nov. 6, the first full business day in Egypt since the Central Bank floated the currency on Nov. 3.

The pound was trading in banks at 8.8 pounds prior to the floatation. The IMF’s executive board has yet to ratify the loan.

The floatation, accompanied by a 48 percent devaluation of the Egyptian pound, is the boldest economic measure taken by President Abdel-Fattah al-Sissi since his election in 2014. For the first time, Egypt’s currency will fluctuate according to supply and demand.

At late Nov. 3, fuel prices were hiked, with gasoline, diesel and the infrequently used natural gas all going up between 30 and 46.8 percent, according to state media.

Past fuel price hikes had a far reaching knock-on effect, triggering a matching increase in food and transport prices. Word of the hikes was leaked late at night, sparking a rush by motorists to gas stations, where long lines of vehicles formed across much of the country.

The Central Bank said in a statement the floatation would “completely end” the black currency market and “empower the Egyptian economy to face the present challenges, unleash its potential and achieve the hoped-for growth.”

Central Bank Governor Tareq Amer was upbeat when he addressed a news conference, saying “this is a big turning point in the Egyptian economy. We could not tolerate dual (foreign currency) markets continuing.”

It may, however, be too early for the government to declare victory in its battle against the unofficial currency market, which has for decades served as a lifeline for a private sector that heavily depends on dollars to finance imports, given longstanding limits on foreign currency withdrawals on the official market and the recent dollar shortage.

“The floatation is an excellent, overdue step that, thank God, we took,” Egypt’s business tycoon Naguib Sawiris wrote on his Twitter account.

“We must all help to make this step a success.”