Economic data warn Erdoğan

This week’s Turkish data releases showed exactly why the government has to end the ongoing protests in a peaceful manner.

This week’s Turkish data releases showed exactly why the government has to end the ongoing protests in a peaceful manner.

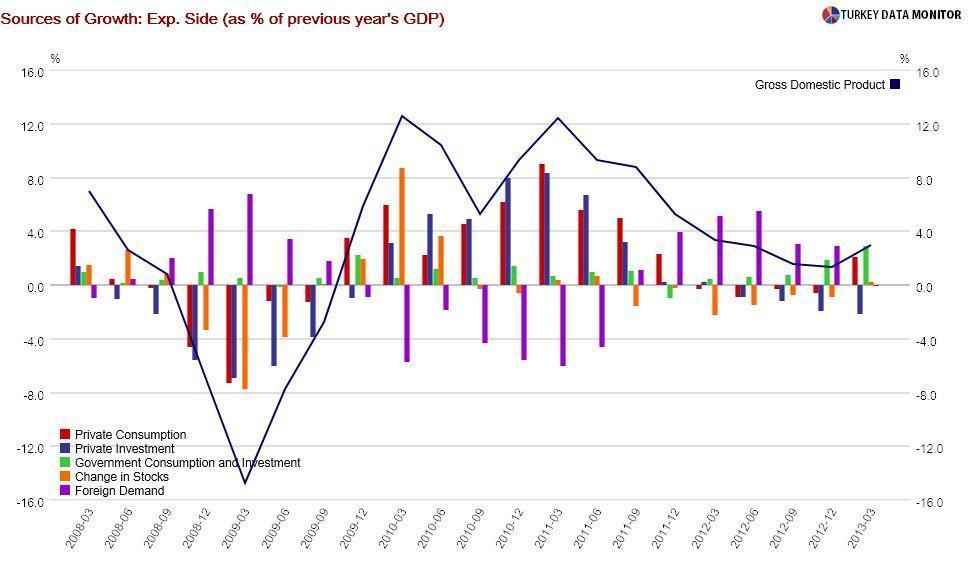

The National Income Accounts for the first quarter, released on June 11, revealed that the economy grew 3 percent annually. Although higher than market expectations of 2.2 percent, it was driven almost entirely by public investment, which rose 82 percent yearly. In fact, Citi economists noted that “if the contribution of public investment were at its historical average, growth would be 0.9.”

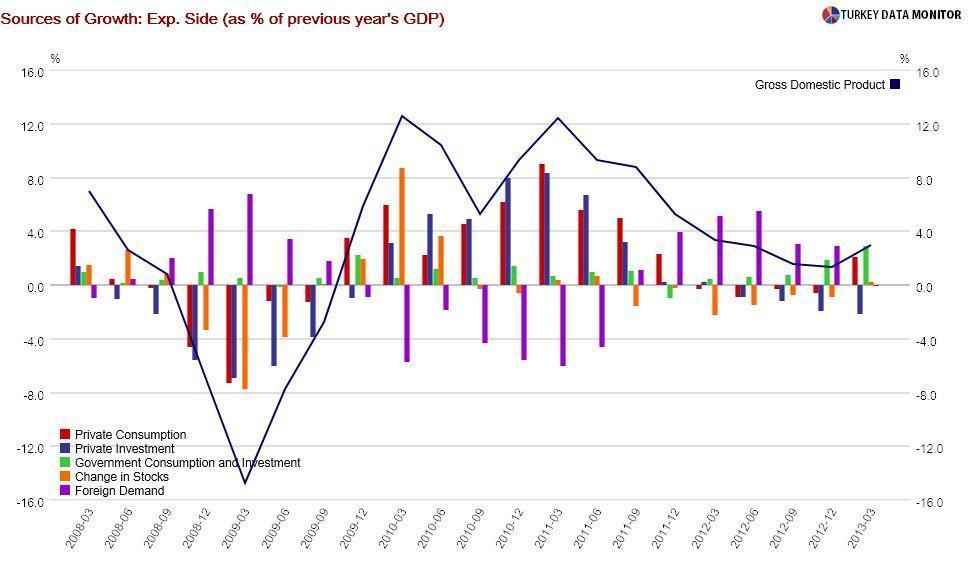

This is the first time in two years that net exports did not contribute to growth. Given Europe’s economic prospects, I would not expect a significant contribution from foreign demand during the rest of the year, either. In fact, the exports component of the May Purchasing Managers Index is at a six-month low. If growth is to hit the government’s 4 percent target, it has to be through domestic demand, which will in turn depend on consumer and business confidence. Continued protests are not the best way to boost confidence.

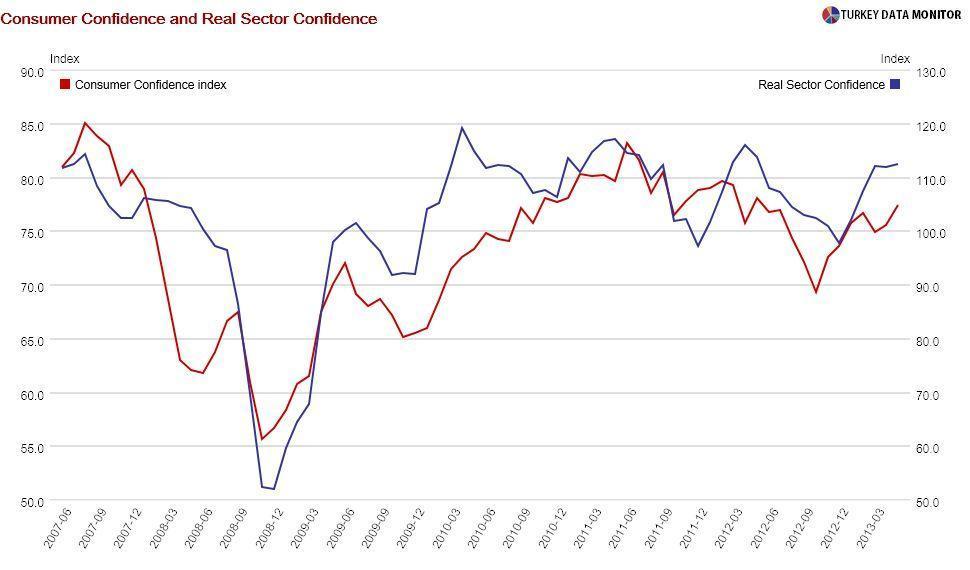

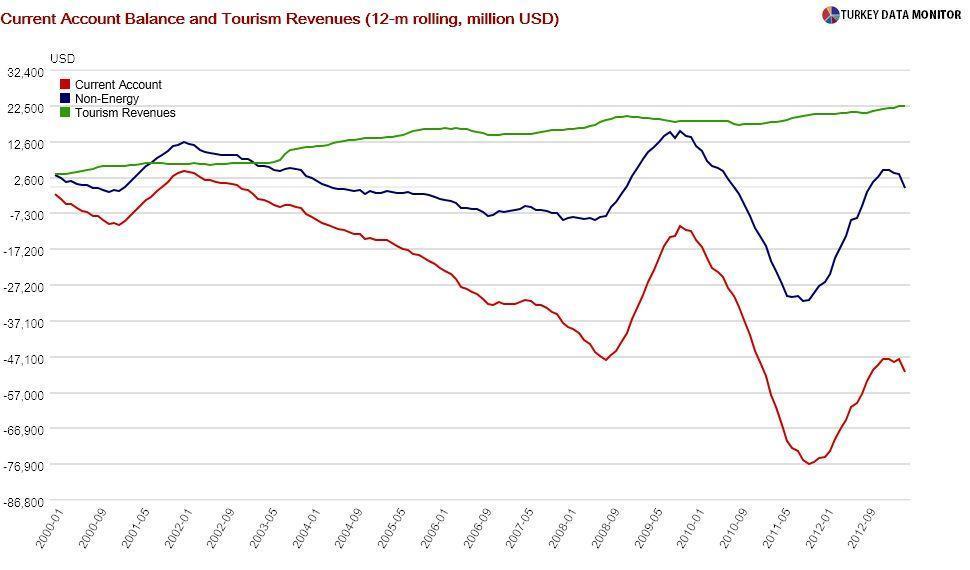

April Balance of Payments figures released on the same day paint an equally bleak picture. The annual current account deficit has surpassed $50 billion. Ongoing protests would widen the deficit further by scaring tourists away - tourism is the largest revenue item in the current account. Hotel searches for Turkey almost came to a stop last week, and there was a one third weekly decrease in bookings with British tour operators.

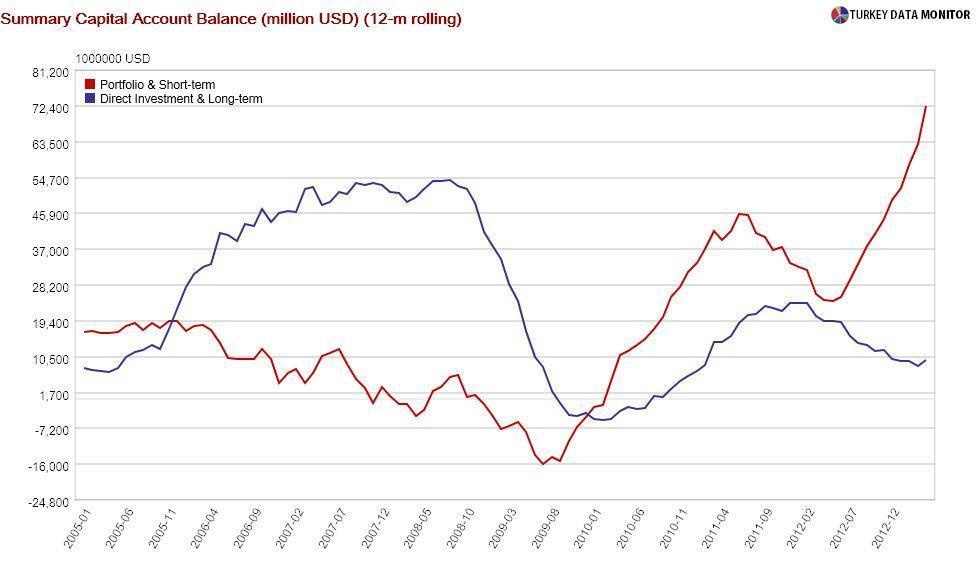

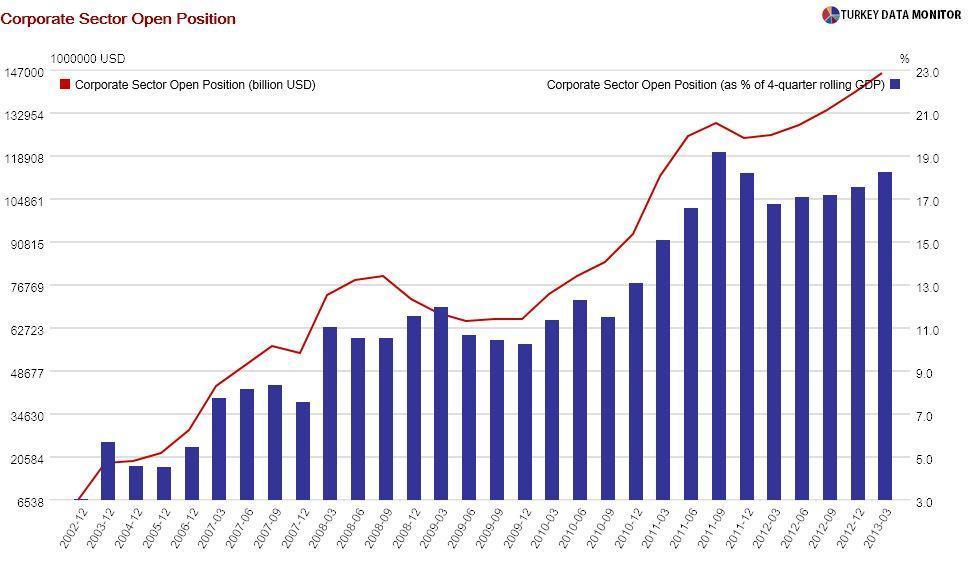

Moreover, almost 85 percent of the $94 billion of capital flows in the past 12 months were short-term. If these flows slowed down, because of domestic or international developments, Turkey would have problems financing its current account deficit and growth. The resulting lira depreciation would not only fuel inflation, but also disrupt the balance sheets of corporates, which have an open position of $145 billion.

As Governor Erdem Başçı noted on June 12, that’s why the Central Bank of Turkey intervened in exchange rate (FX) markets on June 11 after we saw a miniature version of this scenario. There were $464 million of outflows from equities last week, and the lira dollar exchange rate passed 1.90 before the Central Bank sold $250 million of FX and tightened liquidity by not offering funding at the policy rate.

As a result, overnight rates hit 6 percent, which is the lending rate for primary dealers. Therefore, although Başçı said there was no need for it, and none of the economists in business channel CNBC-e’s survey is expecting it, the Bank may raise this rate, which is the ceiling of the interest rate corridor, at its rate-setting meeting on June 18 if there is pressure on the lira. Would this make them part of the interest rate lobby?

[

Economic data were begging Prime Minister Recep Tayyip Erdoğan to make peace with protesters this week. Since he met with their so-called representatives, whom he had cherry-picked himself, on June 12, I am not sure if he is listening or only pretending to listen.