ECB will be decisive on Turkish economy, not Fed, says senior US

ISTANBUL Barış Balcı

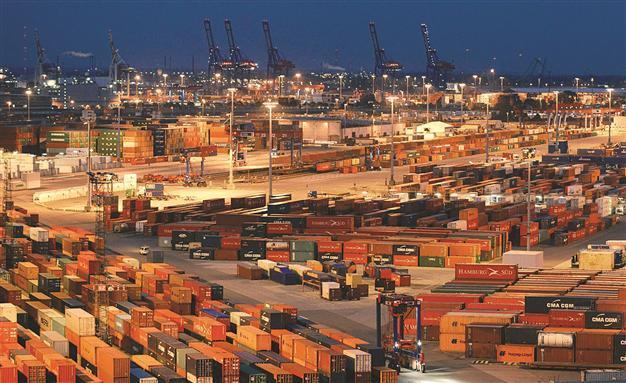

General view of the container terminal “Burchardkai” of the Hamburger Hafen und Logistik AG (HHLA) in the harbour. REUTERS photo

The Turkish economy faces greater threats from problems in Europe than it does from an end to the U.S. Federal Reserve’s stimulus program, a prominent American economist has said.“I think Turkey’s main fragility does not stem from the Fed, rather it is driven by the possibility of eurozone growth worsening,” Paul Bennett, the New York Stock Exchange’s chief economist, recently told daily Hürriyet.

The senior economist, who will lecture Turkish students at Istanbul’s Piri Reis University as a visitor scholar, has taken an unconventional approach to Turkey’s economic woes, as the U.S. Federal Reserve’s bond purchase tapering program has been seen as the main source of the weakness of the lira and the investment environment.

Bannett said the European Central Bank had not reduced its main policy interest rate as much as it can, enabling room for further maneuvering for the bank.

“This could turn into a right step for the bank, but it could also cause a delay in the economic recovery in Europe. The biggest risk for Turkey is the European real gross national product’s failure to gain an upward trend,” he said.

“This situation would hurt demand for Turkish goods and services,” he warned.

Investors and speculators have sold off emerging market assets since the U.S. Federal Reserve made clear late last year that it would gradually taper its massive monthly bond purchase program, which until then had been propping the assets up.

With increasing indications that the Fed intends to wind down the program by year’s end, emerging market currencies have been hit hard, although there has been a let-up in the selling over the last few weeks.

As the lira has become one of the worst-hit currencies, the Turkish Central Bank raised in January all of its key interest rates in a dramatic move to defend a crumbling currency that is among the most vulnerable to another sell-off.

Since the lira has demonstrated a partial recovery in recent weeks, the Central Bank has been pressured by the government to reduce the rates again with the aim of bolstering growth.

According to Bennett, the Turkish Central Bank’s policy changes will be also shaped by the ECB rather than the Fed.

The Central Bank has a challenging task and needs to make an interest rate decision carefully, he said.

“I think it’s logical for the Turkish Central Bank to undertake a rate reduction carefully in the upcoming months. High interest rates were successful in the speculative impact on the lira. The currency rate’s impact on the inflation has also been limited,” he said, praising the January move.