Don’t make central banking interesting

There wasn’t much new about the Central Bank of Turkey’s rate-setting decision last week other than the revelation that “additional monetary tightening may be implemented more frequently in the forthcoming period.”

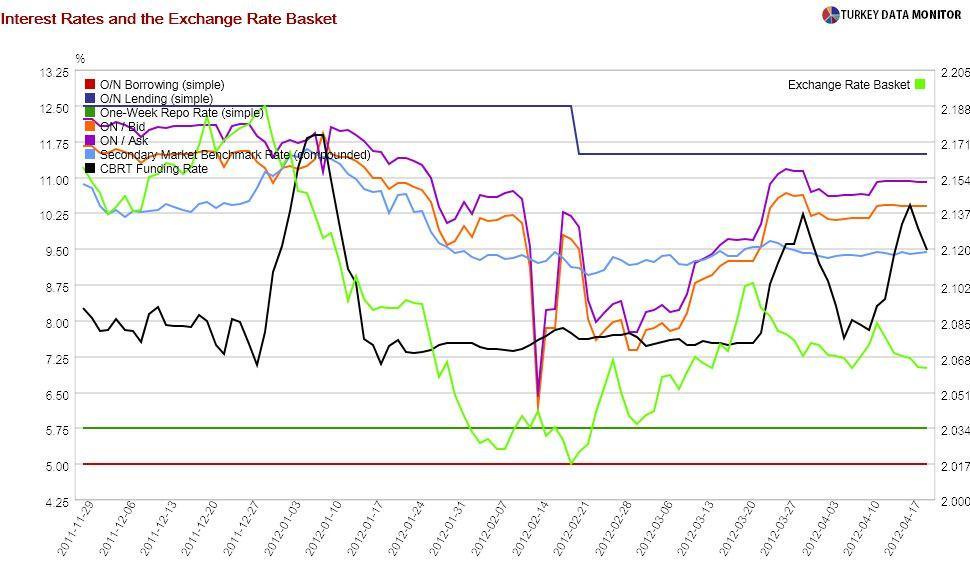

There wasn’t much new about the Central Bank of Turkey’s rate-setting decision last week other than the revelation that “additional monetary tightening may be implemented more frequently in the forthcoming period.”In plain-speak, this means that the Central Bank will revert more to exceptional days, when it didn’t fund markets at the one-week repo rate, which is officially still the policy rate. In a sense, exceptional days are turning out to be unexceptional.

While the Bank says it “will not allow temporary factors to have an adverse impact on the inflation outlook,” market participants believe that it is responding to the excessive depreciation of the Turkish Lira, which I have elaborated upon in my blog. On the other hand, guest blogger Ali G (not the rapper) argues that the Central Bank is merely reacting to the lira’s extreme volatility compared to its peers.

But whatever the Central Bank’s motivations are, it is clear that the one-week repo, which has for some time been the interest rate formerly known as the policy rate, similar to the artist Prince, has replaced the average funding rate of the Bank’s various lending facilities. Since the rate-setting Monetary Policy Committee (MPC) meets once a month, this brings to mind the question of exactly who decides this funding rate, which can be changed any day.

Luckily, Ankara-based investigative journalist Emin Çölaşan has come to the rescue: He has this “tiny bird” that, by virtue of being able to glide in anywhere, always brings him the inside scoop on the latest developments. He let me borrow his birdie, which I duly sent out to the Central Bank HQ in Ulus.

When I didn’t hear from the bird for a few days, I started worrying that Governor Erdem Başçı’s tomcat, Bagehot, had gotten her. But she did eventually return, and she told me that it is the Governor himself, after consulting with markets and banking departments, as well as with the chief economist, who makes the decision.

I have no objection to that, as I have full confidence in the more-than-able Governor. Besides, the birdie, after sneaking into the latest MPC, also told me that he, along with two of the deputy governors, sets the agenda there as well. However, I cannot help but wonder whether this arrangement violates Article 22 of the Central Bank Law, which dictates that monetary policy should be set by the MPC.

In any case, hailing from a country where a president once said that it would be no big deal if the Constitution were violated just once, I am not too worried about such minor “bending” of the law. But I am genuinely concerned about the possibility of some more radical changes to the Central Bank’s policy.

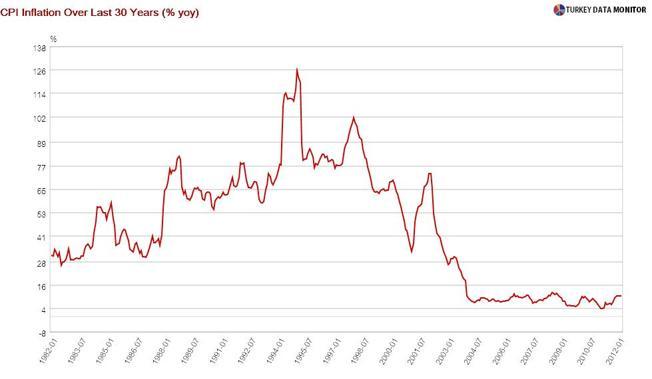

One of these is the suggestion that the Bank should formally give up inflation targeting. Supporters of this view seem to have forgotten that inflation targeting has brought us stability, allowing us to leave behind the era of three-digit inflation. Besides, as monetary economist Michael Woodford demonstrates in a recent paper, inflation targeting is perfectly compatible with maintaining financial stability.

Central banking is designed to be a dull profession, and central bankers boring people, for a reason. Attempts to make it more interesting and exciting are bound to end in tears.