Domestic sales contracting amid Central Bank’s interest moves

Mustafa Sönmez - mustafasnmz@hotmail.com

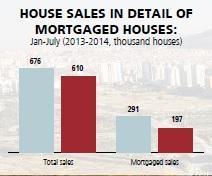

Monthly statistics point to a receding demand for real estate. In July, there was a 20 percent decrease in demand compared to that of last year: There were 85,000 real estate sales, and mortgage sales also decreased by 33 percent.

There has been an apparent stagnation in the markets and even a recession in sales, and recent economic statistics confirm this recession. According to these statistics, housing sales in July failed to reach expected levels; construction continues, but fails to attract new buyers. Even the sales of white goods are low compared to last year’s. The current economic situation forces the Central Bank to lower the interest rates.The interest rates cannot be radically lowered in an economic environment where inflation is above target levels, however. The credit rating agencies indicate that when inflation is considered, the reduction of interest rates will lower Turkey’s credit mark.

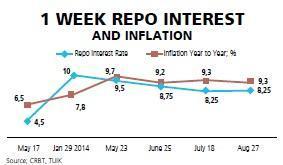

At the beginning of this year, when foreign currency rates were rapidly rising, the interest rate was increased by 5.5 points and froze the markets. It was impossible to lower interest rates considerably due to rising foreign currency rates, as they were threatening; rising product costs also did not allow for the reduction of interest rates. Last week, for example, an expected base reduction of 25 points did not materialize, and the weekly repo interest rate remained at 8.25 percent. This is due to the annual inflation rate, which is a point above the repo interest rate.

Constructors, estate owners and various retail shop owners are complaining about decreasing sales, and they were the ones warning then-Prime Minister Recep Tayyip Erdoğan that this would negatively affect voters’ actions. The outgoing prime minister menacingly demanded that the chief executive of the Central Bank reduce interest rates almost every month. The chief executive did not resist these demands, but he also did not radically reduce interest rates. Despite the serious tendency to raise inflation rates, he acted realistically and did not change the rates.

A statement made after this decision indicates that food inflation, drought and geopolitical risks influenced the decision not to reduce interest rates. This resulted in a steady decrease in interest rates of 1.75 points since January. But this is not a feasible solution for shrinking markets.

Real Estate

Real EstateReal estate is the most important sector that is suffocating in the domestic market. Monthly statistics, especially those about mortgage sales, point to a receding demand for real estate. In July, there was a 20 percent decrease in demand compared to that of last year: There were 85,000 real estate sales, and mortgage sales also decreased by 33 percent compared to the previous July. In the first seven months of the year, real estate sales dropped to 610,000 – 66,000 less than real estate sales in the first seven months of 2013. The most serious reduction, however, is in mortgage sales, which fell from 291,000 to 197,000 in the first seven months of 2014, a decrease of over 48 percent.

Automotive

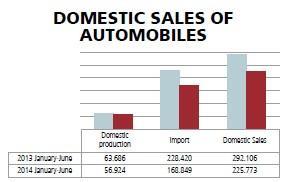

AutomotiveAlongside real estate, there is also a serious decrease of demand in houseware, cars and consumer products. The rise of the value of foreign currency since May of last year — an annual increase of the dollar’s value by 20 percent and the Euro’s by 25 percent – reduced the demand for both foreign and domestic products. The rising value of foreign currency also negatively affected domestic sales by triggering efforts to stop the Turkish Lira’s devaluation through raising interest rates. A reduced use of credit cards and consumer credit due to increased interest rates reduced domestic demands. Many people also canceled or postponed their purchases of products due to rising political risk.

The automotive sector sales face a major recession in domestic markets. The sales, which surpassed 58,000 in June 2013, fell to 47,000 in same month of this year, marking an annual decline of 11,000 units and 19 percent. If we consider the first six months of the year, the situation seems more serious. Automotive sales, which were 296,000 in the first six months of 2013, fell by 30 percent to 226,000 in the same period of this year. The rising value of foreign currency affected decreasing demand in this sector.

Houseware

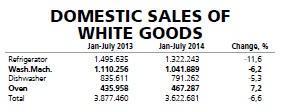

HousewareSales of houseware and appliances, comprising of refrigerators, washing machines, ovens and dish washers, declined by 7 percent in the first seven months of 2014. Domestic sales of fridges plunged by 12 percent during the same period and sales of laundry machines dropped 6 percent. The sector is only held up on its feet by exports, as the sale of washing machines, which also dropped by 45,000 units in the period between January and July. The sales performance in ovens is the only exception in this group. The units sold increased by 7 percent over this period.

Interest rate reduction?

Interest rate reduction?With the decrease in domestic demand – particularly in the housing, houseware and automotive sectors – and with the complaints from several sectors, the pressure on the Central Bank for interest rate reduction will remain effective. It is right to say pressure for perceivable reductions will be ramped up on the new government as the country heads to the parliamentary elections in 2015.

Although the annual inflation rate of over 9 percent does not allow a valid reason such a

reduction, eyes will remain on the Central Bank’s decisions almost every month.