Deputy PM Şimşek: Funds started flowing

İSTANBUL

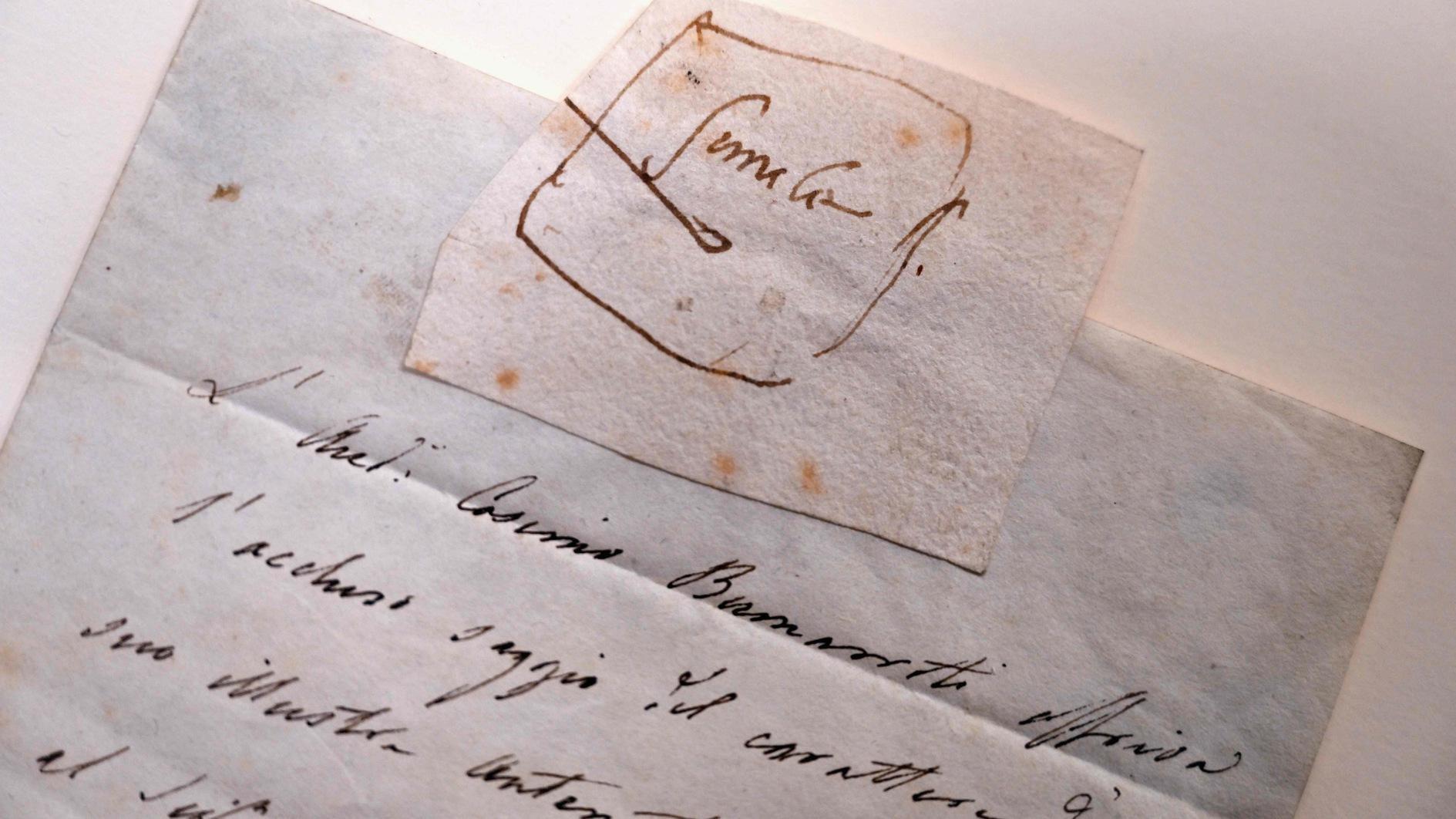

This file photo shows Deputy PM Mehmet Şimşek speaking at an event.

Foreign funds started to flow after international concerns about Turkey’s monetary policy were largely addressed during meetings with investors in London, Deputy Prime Minister Mehmet Şimşek said on June 3.

“The concerns over monetary policy was mainly relieved. That is very clear. Hence, fund inflows have started,” Şimşek said in an interview broadcast on Kanal7 television.

Turkey’s currency has fallen around 20 percent this year, hit by investor concern about the independence of the central bank and President Recep Tayyip Erdoğan’s tightening grip on monetary policy after elections on June 24.

President Erdoğan wants lower borrowing costs to fuel credit growth and economic expansion.

Last week, Şimşek and Turkish Central Bank Governor Murat Çetinkaya met with investors and dialed back on Erdoğan’s combative message to markets on interest rate policy, saying Turkey’s Central Bank is free to defend the lira.

“The depreciation in lira after the meetings is due to the rating agency statements and partly connected with forex demand of companies and citizens,” Şimşek also said on June 3.

The dollar is “relatively under control,” Şimşek said.

“There are local and foreign reasons behind the recent depreciation of the lira,” the deputy prime minister added in the interview.

“There are three basic trends behind the foreign reasons: First of all, the U.S. dollar has gained against almost all currencies since the beginning of the year.

“Secondly, we are at a time when the interest rates are globally going up, including the dollar şintrest rates. The third reason is regarding the oil importing countries: the oil prices were down to almost $40, and has gone up to $80. These three factors affected the value of the lira.”

On June 1, Moody’s put Turkey’s rating on watch for a downgrade, citing concern over economic management and erosion of investor confidence. Fitch placed on negative watch 25 Turkish banks’ ratings.

The Central Bank raised interest rates by 300 basis points to 16.50 percent in an emergency meeting last month to put a floor under lira which has hit a record low of 4.9290 against U.S. dollar.