Chinese central bank warns of inflation, pledges market reforms

BEIJING - Reuters

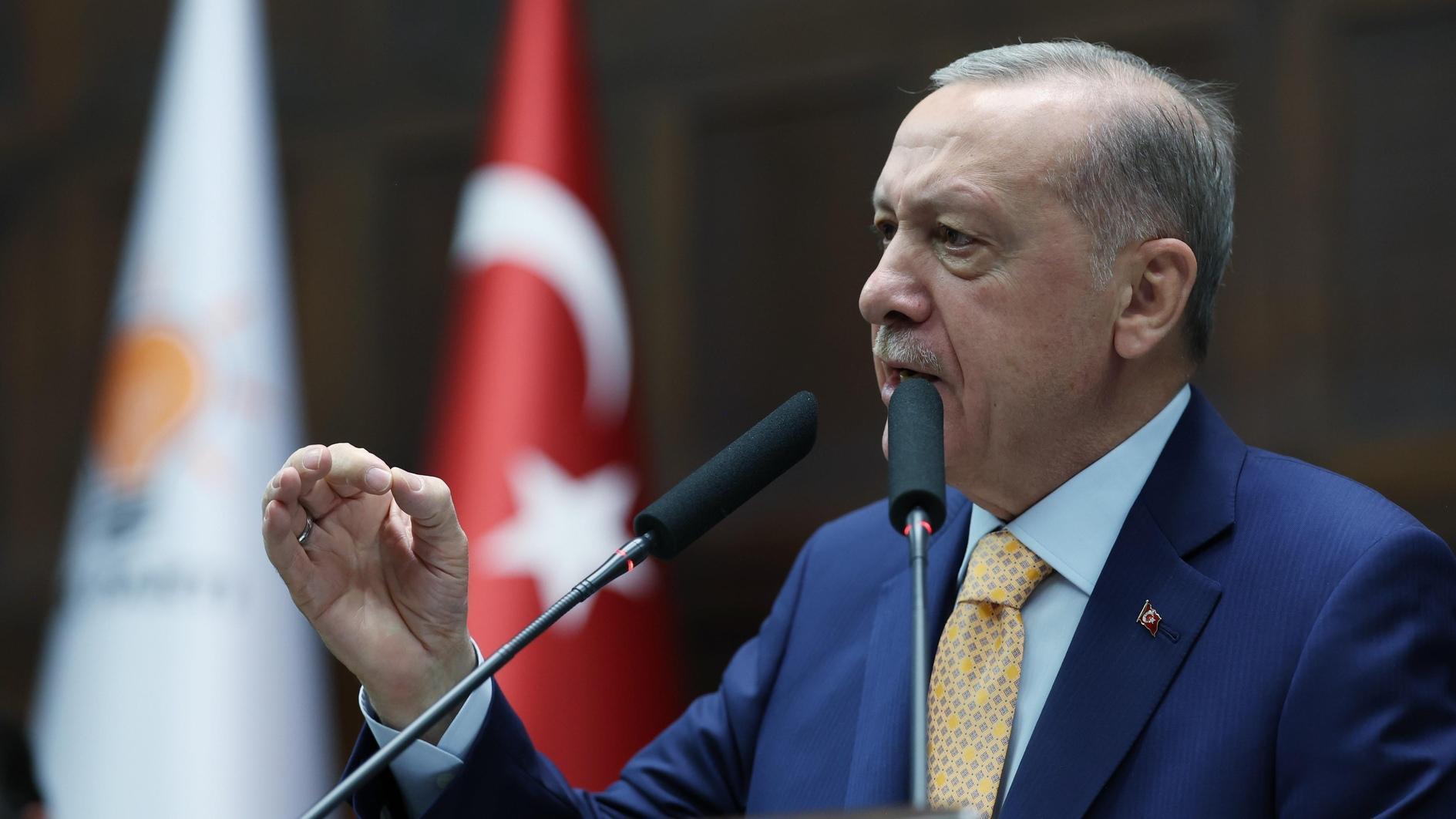

China’s central bank governor Zhou Xiaochuan (C) attends the opening ceremony of the Chinese People’s Political Consultative Conference (CPPCC) at the Great Hall of the People in Beijing March 3. REUTERS photo

China must stabilize inflation expectations, the head of the People’s Bank of China said yesterday, vowing to vigilantly manage the risks of rising prices as the central bank’s first priority while also pledging further capital market reforms.Governor Zhou Xiaochuan, in comments that further reinforce the market’s view that the PBOC has dropped the pro-growth policy mix of 2012, said the central bank’s stance had shifted to neutral from loose and that policy was now prudently set to rein in the risk of rising prices.

“The central bank has been paying high attention to inflation figures and we will stabilize inflation expectations via monetary policies,” Zhou told a news conference on the sidelines of China’s annual meeting of parliament.

“February CPI was slightly higher than expectations, suggesting that we need to keep vigilant on inflation,” Zhou said when asked about a spike in annual consumer price inflation to a 10-month high of 3.2 percent in February.

The PBOC chief pledged to maintain a drive for reforms to the country’s financial markets and the capital account, which remain tightly controlled, and would respond to market demand for freer access to the tightly managed yuan currency.

“The rising demand for yuan’s broader use in trade and investment will help push forward yuan capital account reform,” Zhou said.

Reuters reported earlier this month that China is set to use swelling offshore holdings of its tightly-managed currency worth around 1 trillion yuan ($160 billion) to justify a landmark shift in tactics to relax capital controls.

Investors expect China to make its currency basically convertible by 2015, or 2020 at the latest, and have anticipated that monetary authorities would do so according to a series of time-tabled steps.

“We know that overall this is a very complicated process and we will stick to the principle of carrying out the reform in a gradual way,” Zhou told the news conference.

PBOC Deputy Governor, Yi Gang, told that the central bank was closely watching for any impact on China of the loose monetary policies being pursued by major central banks to help promote growth in their home economies.

‘Avoid competetive depreciations'

Central banks in the United States, the eurozone, Japan and the United Kingdom have been following unorthodox monetary policies, including quantitative easing, which has weakened or restrained their currencies in consequence and raised the risk, according to some economists, of a currency war.

Yi, who also heads China’s currency watchdog, the State Administration of Foreign Exchange (SAFE), said the world’s major economies should avoid competitive currency depreciations.

“All G20 countries should strictly follow the communiqué made at the latest summit to set their monetary policies based on their country’s economic conditions and avoid competitive depreciation,” Yi said. Group of 20 (G20) economies agreed at a February meeting to avoid a currency war, committed to refrain from competitive devaluations and pledged that monetary policy would be directed to achieve price stability and growth.