Bird or Central Bank watching: Which is easier?

Despite a lot of push from a world-renowned ornithologist friend, I never took up bird-watching. It seemed way too difficult to wait for hours to catch a glimpse of a small unidentified flying object and try to identify it.

Despite a lot of push from a world-renowned ornithologist friend, I never took up bird-watching. It seemed way too difficult to wait for hours to catch a glimpse of a small unidentified flying object and try to identify it.I was in Ankara on March 15 to, among other things, give a guest lecture at a class in the Middle East Technical University on “Central Bank watching,” (i.e. how market economists follow the Central Bank of Turkey). Since the Bank’s monthly rate-setting meeting is being held tomorrow, I should summarize my lecture.

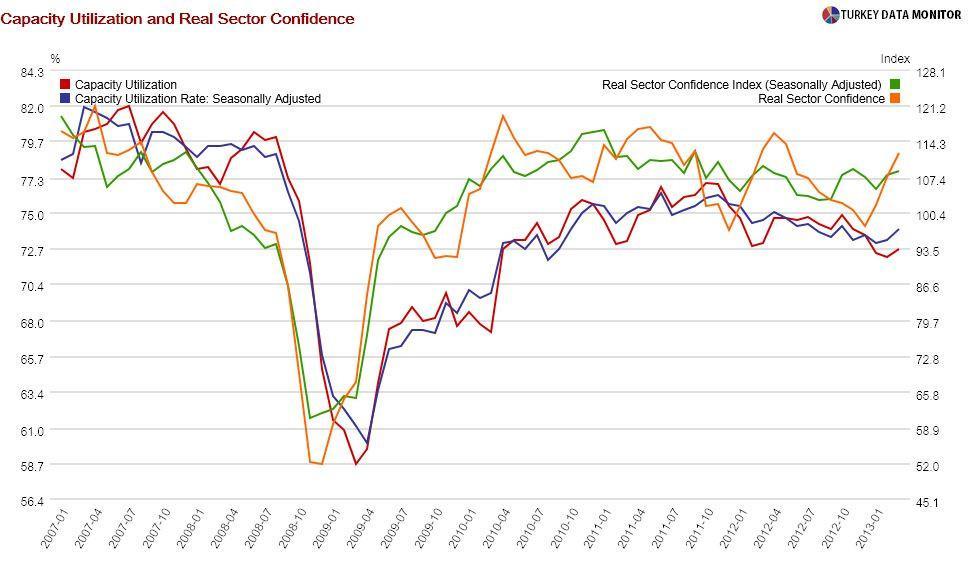

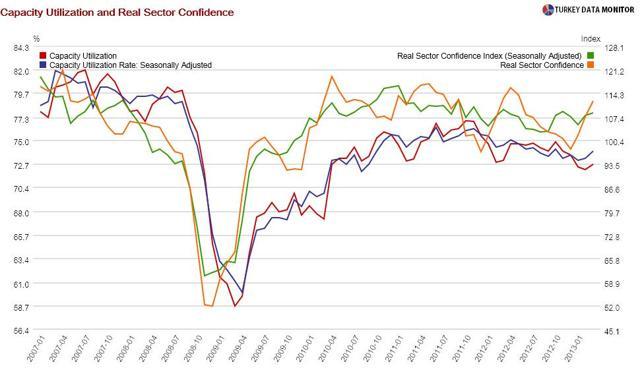

I noted in my March 18 column that tax revenues from the February budget left no doubt that economic recovery was underway. The economy continued to recuperate in March, as evidenced by the capacity utilization rate and real sector confidence index, which were released by the Central Bank on March 22.

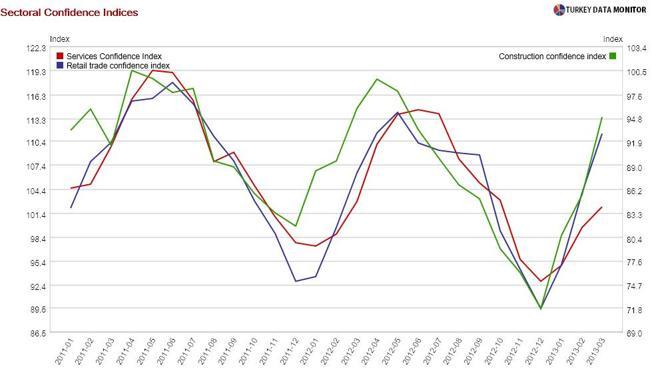

Moreover, the sectoral confidence indices released by the Turkish Statistical Institute on the same day show that the improvement in sentiment is across the board. Therefore, economic conditions do not warrant a rate cut.

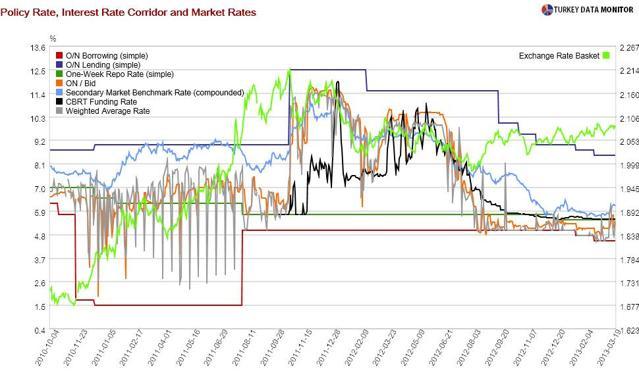

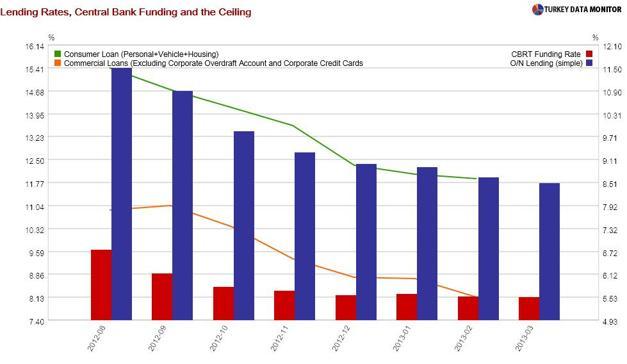

The Central Bank could widen the interest rate corridor by lowering the overnight borrowing rate, which is the floor of the corridor, to discourage excessive capital flows that would appreciate the currency. However, weekly flows data showed that foreigners sold $1.6 billion of bonds during the week of March 15. Weak demand at last week’s auctions hinted that this trend is continuing.

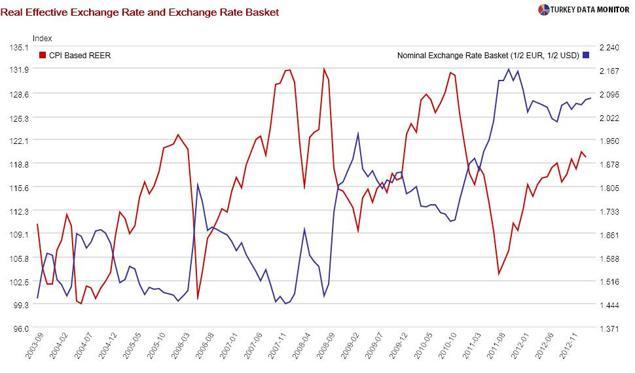

Besides, the Central Bank has been burned once, in the fall of 2011, from cutting rates right before a European meltdown. Even though I do not believe contagion from Cyprus is likely, I do not think the Bank would take the risk. In any case, the real exchange rate is probably below 120, the threshold level above which the Central Bank would ease policy.

Finally, the Bank is likely to increase reserve requirement ratios further to curb loan growth. At 21.5 percent, the annualized and foreign currency-adjusted 13-week moving average of credit growth, which is the Bank’s chosen metric to track lending, is higher than their target of 15 percent.

The Bank is more tolerant of commercial lending, which is not growing as fast as consumer credit. They have been arguing that the overnight lending rate has more effect on commercial than consumer loan rates, so they could end up lowering it. Then, if they did not want to narrow the corridor, they could go for a cut in the borrowing rate as well. But my base scenario is no cut.

To sum up, I am trying to guess how the Bank will change the policy rate, interest rate corridor and reserve requirement ratios. To do that, I look at how the economy is doing as well as credit growth, the real exchange rate and capital flows. Nope, I did not forget inflation. Although the Central Bank is still targeting inflation on paper, economists believe it is very low on the Bank’s agenda.

I should have taken up bird-watching. It would have been easier than watching the Central Bank of Turkey.