Be wary of ‘unseasonable spring’ in markets

Mustafa Sönmez - mustafasnmz@hotmail.com

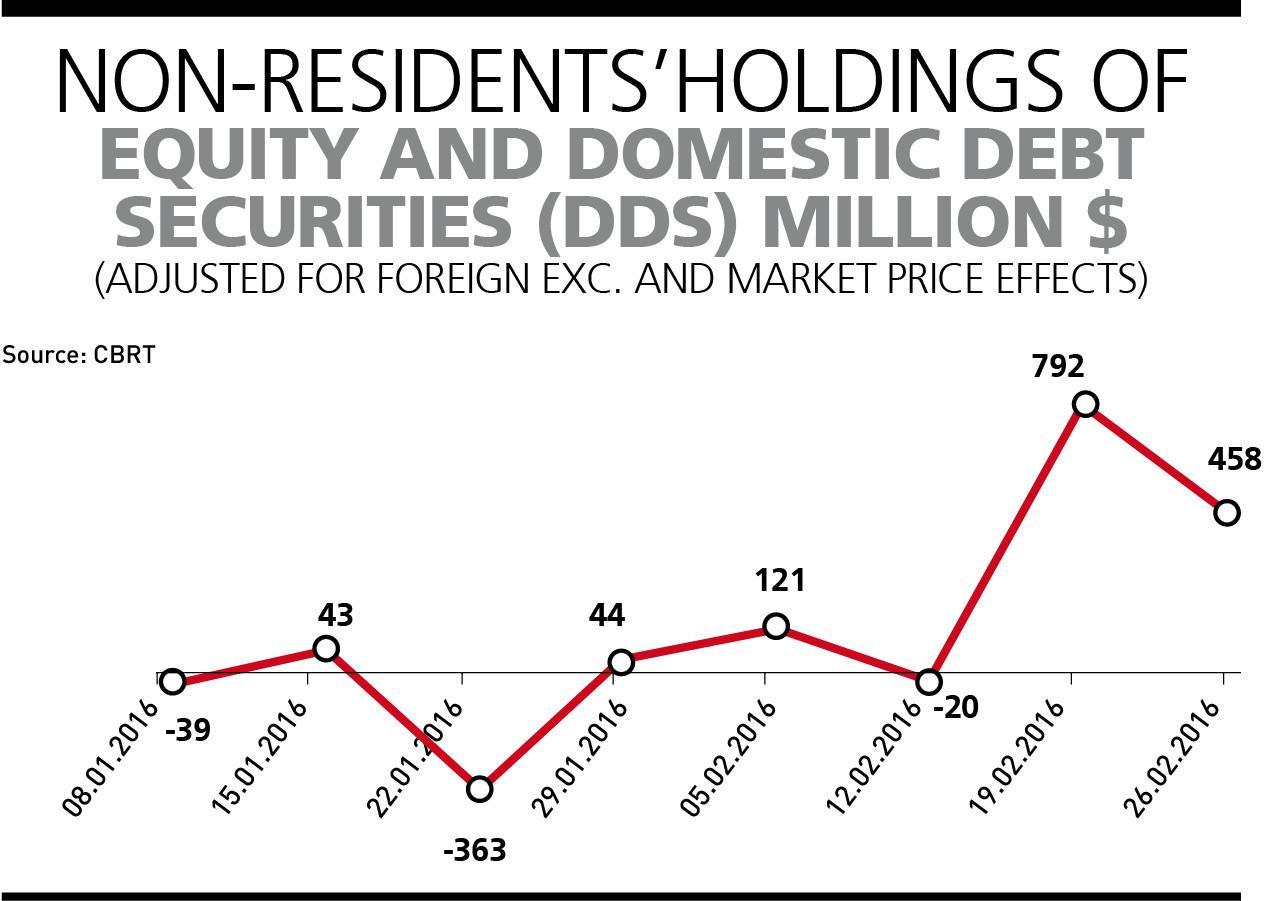

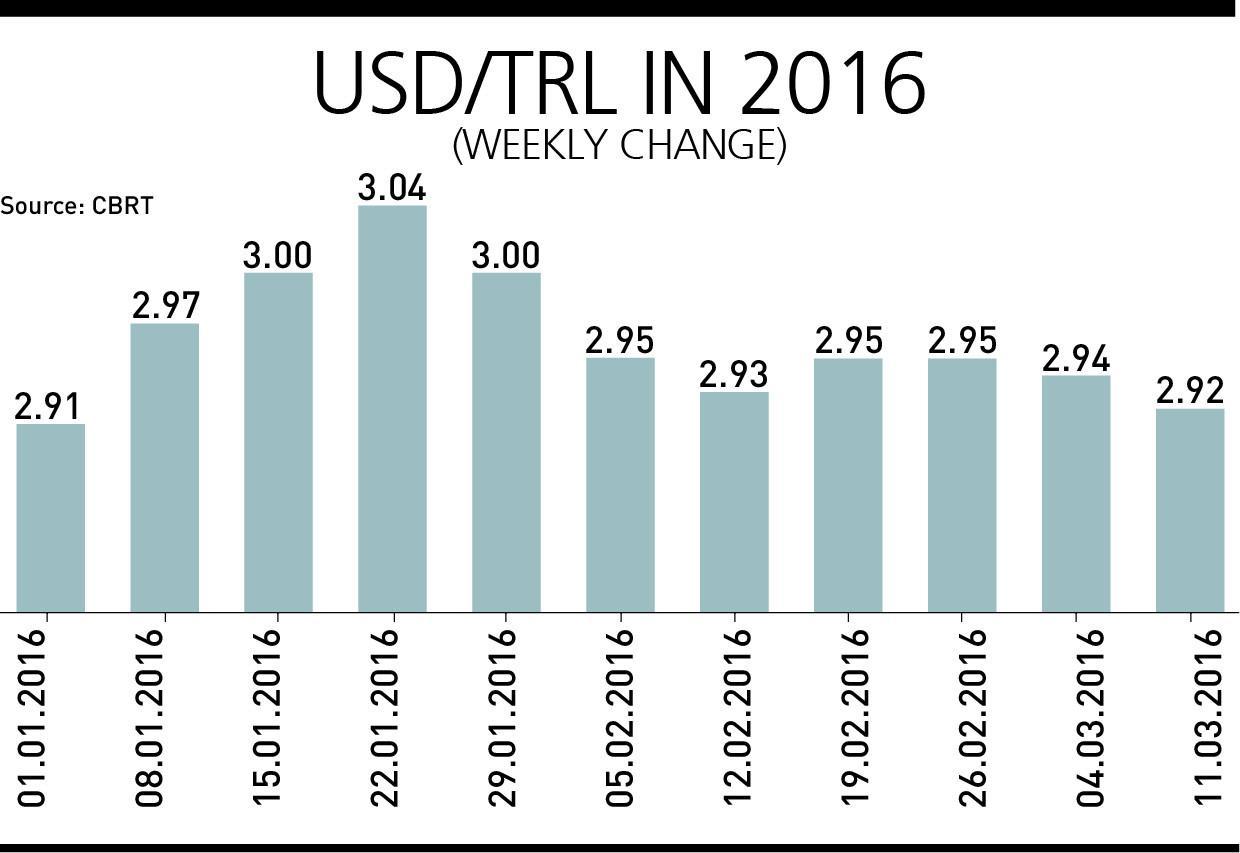

With the effect of foreigners entering the Borsa Istanbul, the dollar exchange rate, which had gone up to over 3 liras in mid-January, fluctuated between 2.95 liras and 2.91 liras in the following weeks, triggering hopes it would fall below 2.9.

Even before the half-way point of March, an optimistic wind is blowing in the market. This is an optimism that is mostly based on the expectation that the U.S. Central Bank (Fed) will delay its rate hikes. We have seen that foreign funds with an inclination to withdraw have partially returned to emerging countries, including Turkey. This has affected the dollar/Turkish Lira price and the dollar has been pulled down to the 2.95-2.90 band.Optimism is fueling expectations that the dollar will even go below 2.90 liras. Well, is that so? Is the Fed’s postponement of rate hikes a permanent trend and will foreign funds affected by this pull down local currencies and pave the way for an unseasonable spring?

The dollar/lira average in 2015 was 2.72 liras. Will Turkey be able to keep the price of the dollar at around 3 liras in 2016 and maintain some 10 percent depreciation?

The capital mobility in the first two months of 2016 has nurtured this hope. The foreign funds stock in the Istanbul bourse, which had decreased to $67 billion on Jan. 22, went up to $75 billion at the end of February.

With the effect of foreigners entering the Istanbul bourse, the dollar exchange rate, which had gone up to over 3 liras in mid-January, fluctuated between 2.95 liras and 2.91 liras in the following weeks. This trend created hopes that maybe it would fall below 2.90 liras.

How could it be explained that foreigners are heading for Turkey, despite the fact that the country is going through economic fragility, tension in domestic policies and particularly geopolitical risks? The widespread interpretation is that this might be a temporary “hit and run” operation.

The general opinion is the Fed will spread the delay of rate hikes over time. Both the EU and China will be affected by this, and thus all global actors.

The true trends

The effort to return from the bottom, which has been observed in Turkey’s economy in the past month, is not unique to Turkey. Somehow this has been observed in almost all emerging countries. There has been a recovery in the indexes, there has been - even though in small amounts - a return of capital to developing countries.

Is this recovery permanent? To be able to distinguish an “early and false spring,” it is good to remember general tendencies. Morgan Stanley’s emerging markets index (MSCI EM) has declined 25 percent in the past year.

Indexes in Brazil, Russia and India lost between 20 and 25 percent in the same period. Even though it looks as if each country had different reasons for those losses, actually sales in developing markets have common factors. The first factor is the Fed entering a period of rate hikes and the fear dollar liquidity will return.

The second important factor is the faster and harsher than expected cooling of the Chinese economy. The sharp devaluation of the yuan has triggered panic. Another factor is that macro-economic data in countries dependent on oil revenues has been disrupted as a result of oil prices falling to 2009 crisis levels.

In addition to these factors, in emerging countries such as Turkey which have been exposed to the war and risk in Syria and the Middle East, the geopolitical risk premium increased. Besides, because of the slow course in the recovery of global economies, commodity prices remained at historically low levels, thus causing budget deficits in those countries which depend on commodity sales. And of course, the two biggest economies of the emerging countries, Russia and Brazil, are shrinking.

The list can go on but these are the generally accepted reasons. There is no significant change or a possibility that the circumstances cited above may disappear. Since the U.S.’ stance is the key, it has to be the focus.

If not in March…

When funds partially returned - if not poured - into countries like Turkey, the determinant factor in this was the expectation that the U.S. rate hikes would not happen in March. The U.S. has two targets: To pull down the rate of unemployment below 6 percent and stabilize inflation at around 2 percent, so that the rates would increase peacefully in time. Because if inflation does not go up, then hiking interest rates would mean the real rates, in other words, net of inflation, will remain very high…

The most logical thing to say is that the possibility there would be no hikes in March was quite high, but a hike in rates for instance in June could very well be accepted in the markets. This could be a sign that the spring we are going through does not have too many days.

Based on this, we can say that market developments will totally depend on global markets in the period ahead.

In Europe

Another factor which determines foreign funds’ traffic to emerging countries like Turkey is the climate in the EU.

The global crisis arrived in Europe slightly late, in the year 2009, and again it is possible to say the recovery of Europe has been quite late. The EU Central Bank opted for monetary expansion last year and increased growth. There was an ease in the markets when stock exchange values increased. However, now, about a year later, there is a situation, as deflation is returning and the bourses are weakening.

The European Central Bank is likely to intervene again. February data showed the situation was weak and EU consumer prices fell 0.2 percent at the beginning of 2016. Of course the fall in oil prices has a significant impact on inflation. In the 12-month period from February 2015 to February this year, prices increased only 0.7 percent. This is the lowest inflation in the 17 years since the euro was born.

The European Central Bank had bought bonds each month worth $65 billion at times when it was in monetary expansion but had never been close to its 2 percent inflation target.

On the other hand, unemployment continues to fall. Also in Europe, investments are not moving which strains European exporters in an environment where China is weak and developing countries are suffering difficulties. For this reason, in three big eurozone countries, Germany, France and Italy, industrial production continued to fall. The European Central Bank looks like it will continue monetary expansion and negative rates but whether it will be able to do it for another turn is not known, and it’s definitely not easy…

Direction…

The expectation in the financial world is that, in a couple of months, the Fed will absolutely have to hike rates. Bank executives share the opinion that no matter what the situation in China and no matter what decision the European Central Bank makes, the Fed will hike rates at least two or three times this year.

Everybody sees that unless the Fed does this, it will not be able to steer the U.S. and global markets. Thus, everybody can predict that will inevitably be reflected in Turkey and that in the second half of the year, at the latest, there will be difficulties and foreign resource inflow will decrease. This would also mean the slowdown of the credit growth rate and economic growth. As a result, bad loans will increase and it will be inevitable that exchange rates and interest rates will increase… It is high probability that the spring will turn into fall and it is good to keep this in mind at all times…