Banks issue bonds on upgrade hopes

ISTANBUL - Hürriyet Daily News

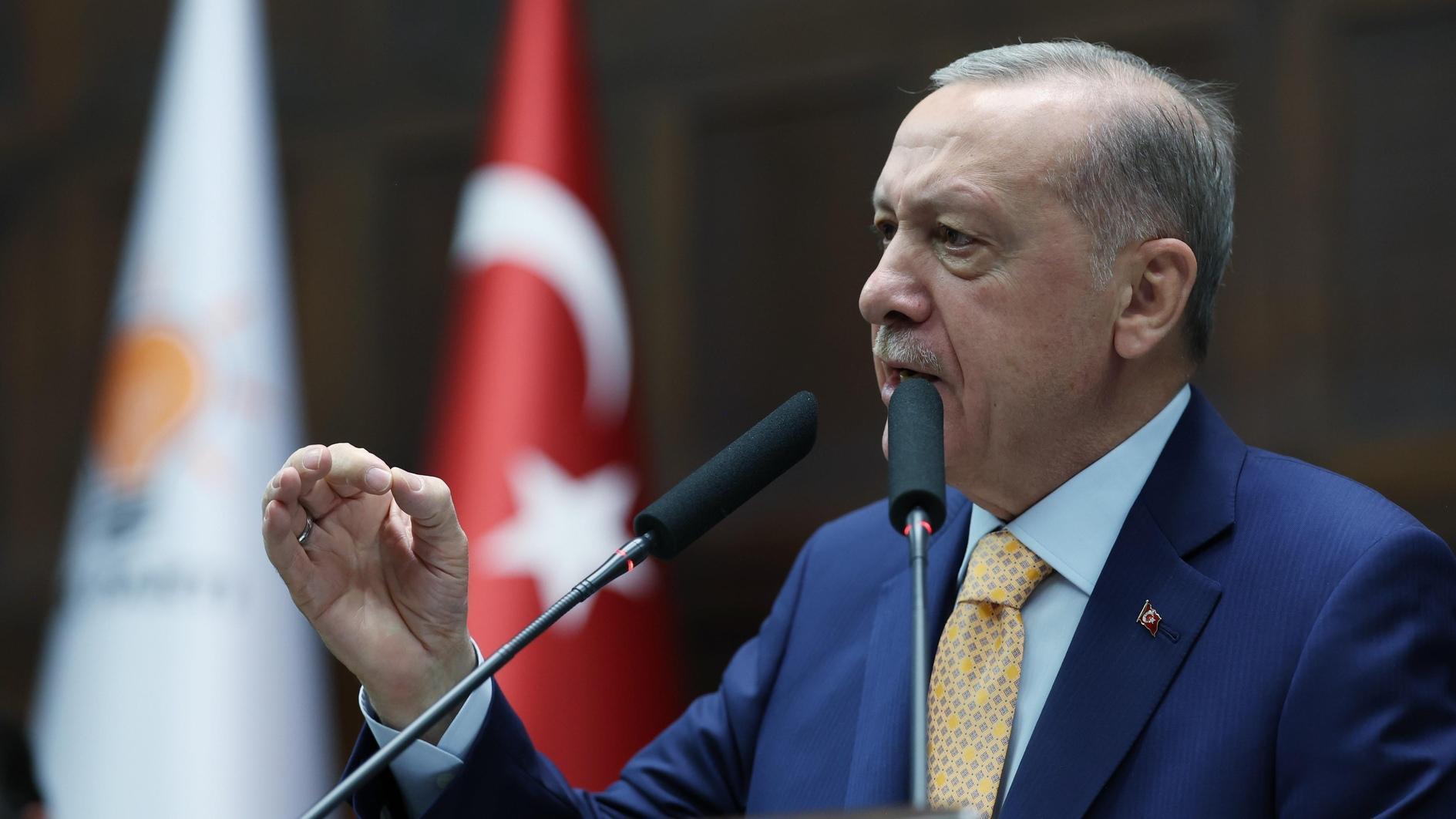

This file photo shows the İşbank towers in Istanbul. Banks including İşbank have sold $5.9 bln in bonds. Hürriyet photo

When a Turkish brewing company issued a U.S. dollar bond last week more cheaply than its government, the message to international debt markets was clear: expect a flood of bonds from Turkish issuers in coming months.Already, Turkish banks are on track to issue more than double the amount of foreign bonds this year compared to last year. The surge is likely to continue in 2013, as the country’s expected upgrade to investment status lures investors.

Lenders including Akbank and İşbank have sold some $5.9 billion in foreign currency-denominated bonds so far this year as they look to lengthen their debt maturities and diversify their sources of financing at low cost.

The figure is expected to rise to around $8.5 billion by the end of this year, bankers say, well over twice the $3.4 billion that Turkish banks borrowed abroad last year.

“Turkish banks want to take advantage of the abundant global liquidity. The nominal interest rates that Turkish banks pay are still very attractive for investors,” said Cihan Saraoğlu, a banking analyst at Ekspres Invest.

Many of these investors “borrow money from the European Central Bank with a rate close to zero percent and lend it to the Turkish banks with an interest rate of around 5-6 percent.”

Firms outside the banking sector, which did not issue any foreign bonds last year, are also seizing the opportunity. Conglomerate Calik Holding and oil refiner Tupras mandated banks this month for planned dollar eurobonds.

Brewer Anadolu Efes, which issued a $500 million, 10-year bond last week at a yield almost 10 basis points inside the Turkish government’s benchmark 2022 notes, says it may become a frequent issuer in the market.