Another surprise from the Central Bank?

The Central Bank of Turkey will be holding its monthly rate-setting Monetary Policy Committee (MPC) meeting tomorrow.

The Central Bank of Turkey will be holding its monthly rate-setting Monetary Policy Committee (MPC) meeting tomorrow. Of the twelve economists polled by business channel CNBC-e, four expect a cut in the floor of the Bank’s interest rate corridor. Of these four, only one expects the ceiling of the corridor to be lowered as well. All the economists believe the Bank will not change its policy rate. In sum, there is quite a bit of consensus that the Bank will not do much.

The Bank’s consumer price index-based real effective exchange rate (REER) index will probably be the most important factor in the MPC’s decision. Governor Erdem Başçı revealed on Nov. 12 that the Central Bank would ease policy gradually if REER appreciated to the 120-125 range, whereas a REER level above 130 would elicit a strong policy response. The Bank does not want a strong lira for fear that it will cause the current account deficit to rise again.

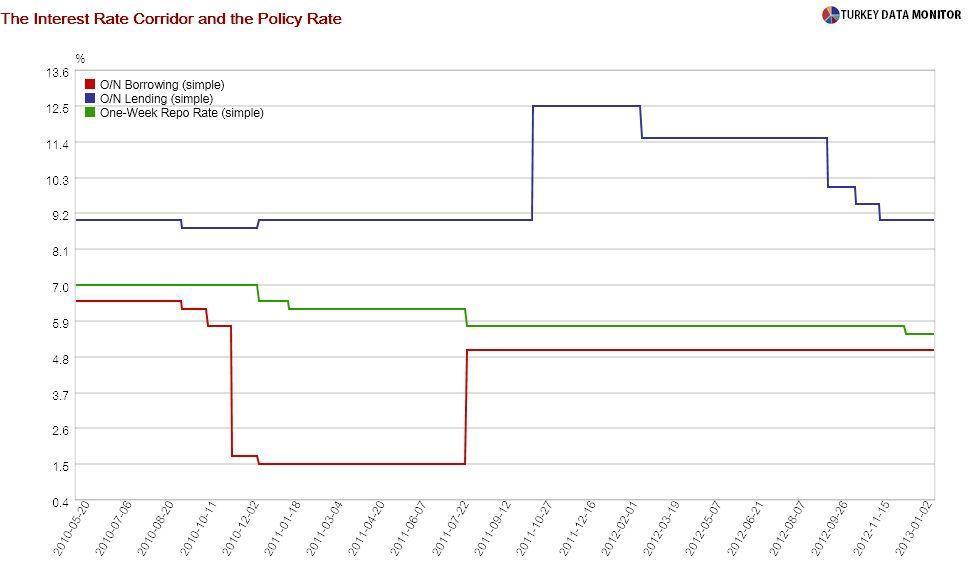

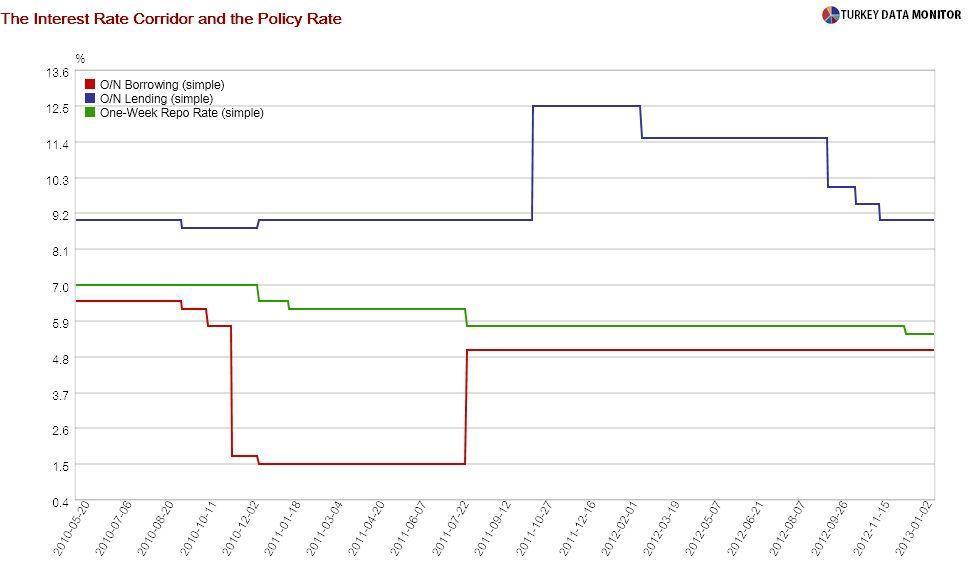

Since REER is calculated using the inflation differential between Turkey and its trading partners, it is a monthly dataset. The Bank only cut the policy rate by 25 basis points at its December meeting, as Başçı managed to talk the lira down with his remarks: After reaching 119.4 in November, REER was 118.3 in December.

However, the lira has appreciated since then and especially last week. The exchange rate basket, which is simply the average of the currency’s values against the dollar and the euro, started the week above 2.06. By the end of the week, it was below 2.05, the level that corresponds to a REER of 120 according to several Turkey economists.

I think such a linear association is a bit crude, as it does not take inflation into account. PriceStats, a company that collects prices for many countries, publishes daily inflation for the United States (U.S.). Using that data, I calculated the real exchange rate between Turkey and the U.S. I then looked at the relationship between my index and the Central Bank’s to estimate the latter’s current value, which turned out to be 122.6.

I ended up with such a large number not only because of the recent lira appreciation, but also because I am penciling in 1.4 percent monthly inflation for Turkey in January, owing mainly to the recent tax hikes. On the other hand, there hasn’t been a major change in U.S. inflation this month.

But that doesn’t mean that the Central Bank will actually loosen monetary policy tomorrow. Deutsche Bank’s Turkey economist Cem Akyürek believes the Central Bank would be willing to absorb a bit more appreciation to support disinflation. After all, I expect yearly inflation to jump to 7 percent this month and then stay there for the next couple of months. The Bank’s end-year target and forecast are 5 and 5.3 percent respectively.

Unlike Akyürek, I don’t think the Bank cares much about the target. But I agree with him that they may not want to repeat the mistake they did back in 2011 by easing prematurely. After all, once bitten, twice shy.