A Turkish perspective on the Fed

While it may not be as innovative as the Central Bank of Turkey, or CBT, the U.S. Federal Reserve, or Fed, is doing its own policy experimentation.

At Wednesday’s rate-setting meeting, the Federal Open Market Committee, or FOMC, predicted low interest rates until late 2014 and set a formal inflation objective of 2 percent. Moreover, for the first time it published FOMC members’ individual forecasts (anonymously) for the evolution of the policy rate over the next few years and the timing of the first hike.

There has been abundant commentary on these actions, by people who know American monetary policy much better than I do. But I thought that I could nevertheless offer some unique insights as an economist from an emerging market that has adopted unorthodox monetary policy for quite a while.

With interest rates already at zero, the Fed does not have many options left at this point, barring yet another round of quantitative easing, the much-awaited QE3. But at $3 trillion, its balance sheet is already 20 percent of GDP. Therefore, it makes sense to try to loosen policy by signaling that rates will remain low without actually going for QE3 first.

But then you can easily see that the Fed’s own forecasts are begging for QE3: For example, inflation in 2014 is forecast to be lower, on average, than the 2 percent target. Similarly, unemployment projections are too high, unless the Fed is expecting a surge in labor force participation, which would not make sense given their low growth forecasts. This all seems like Chairman Bernanke is paving the way for QE3. They don’t call him “Helicopter Ben” for no reason!

If I am right, we could see more signs of this impending quantitative easing when the FOMC meeting minutes are released in the next couple of weeks. And since the Fed, unlike the CBT, does not change monetary policy by the day, QE3 could be announced at the earliest at the next FOMC meeting on March 13th.

Now, you know why CBT Governor Erdem Başçı looked so hung-over during his TV interview at Davos Thursday morning. I am sure he and his able staff figured all this out much before I did, so he must have partied until the wee hours of the morning. If the Fed’s QE3 were to come soon after the European Central Bank’s second round of three-year lending to banks at the end of February, emerging markets could be flushed with liquidity, which he desperately needs for a stronger lira.

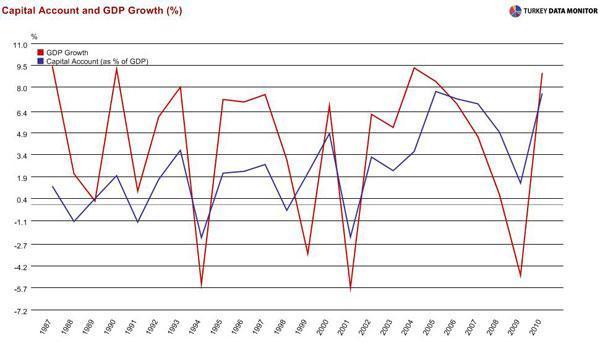

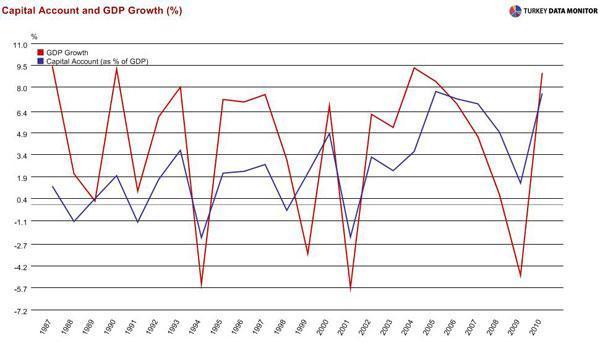

That

liquidity could boost the Turkish economy, which is currently poised for a

gradual slowdown. Ironically, it could also cause its undoing: While it would

make the realization of the government’s 4 percent growth for this year more

likely, it would also increase the chances of a crash landing somewhere down

the road. After all, the Turkish growth model is based on external financing,

and abundant capital means a large current account deficit.

Başçı

recently highlighted

that the deficit could cease to be a topic of discussion in the next 3-4

months. That would not be the case if Turkey were exposed to strong capital

flows. And as Harvard University’s Dani Rodrik recently noted, “few current

account deficits as large as Turkey’s have ever ended well”.