A relief for the current account deficit: Foreign exchange in service sector

Mustafa SÖNMEZ Hürriyet Daily News

Between 2003-2012, tourism had the biggest share in service exports, and $205 billion of income was obtained from tourism. The net foreign currency contribution of tourism was $168 billion. DHA photo

Turkey’s current account deficit, which broke a record by reaching $75 billion in 2011, did not stay below $47.5 billion even in 2012, when the growth rate was only 2 percent. Especially when the “gold effect” – showing debts paid in gold to Iran as exports – is considered, it can be said that the current account deficit reached $53 billion and did not go below the 7 percent of national income. The total current deficit of the first three months of this year is equal to the first quarter of 2012, which is $16 billion. Leading indicators of the first quarter do not look very promising in terms of growth. Economy Minister Zafer Çağlayan’s estimations are also parallel to this.The high rates of current deficit in Turkey basically stem from the gap between export and import activities. This problem particularly got worse in the period after 2002. Both the settlement of the internal balances with the IMF program after the 2001 crisis and the vastness of liquidity abroad enabled significant amounts of foreign source inflow to Turkey after 2002.

However, since the foreign sources entering the country focused on domestic market and could not be led towards export and exporter industries, which enable foreign currency gain, the imports showed a rapid increase. Low-rate policy that was adopted to enable constant source inflow made source inflow attractive but did not support export activities; contrarily, it triggered imports. The economy, which annually obtained an average of $108 billion income from exports, or a total of $1,086 billion in the 2003-2012 period, has made imports costing annually $153 billion or $1,532 billion in total within this decade. The result is: $446 billion of foreign trade deficit within a decade. And when the foreign transfers such as interests and profits are added to this, the deficit gap grows even wider.

Net exporter in service sector

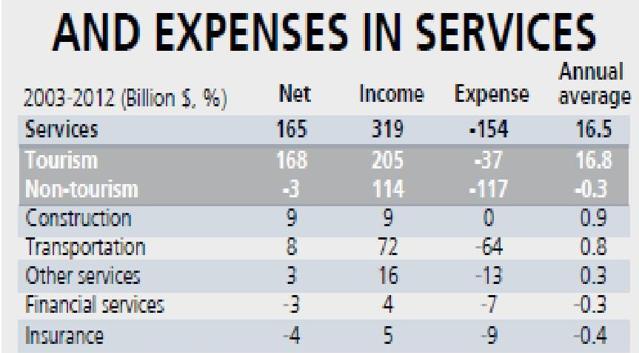

Having a large deficit in foreign trade in goods, Turkey does not have any deficit, and even has a surplus, in the service sector. With this surplus, the country tries to compensate for the deficit in merchandise trade. The $333 billion total current account deficit of the last decade, which corresponds to an annual deficit of $33 billion, is partially owed to the foreign currency earned in the service sector.

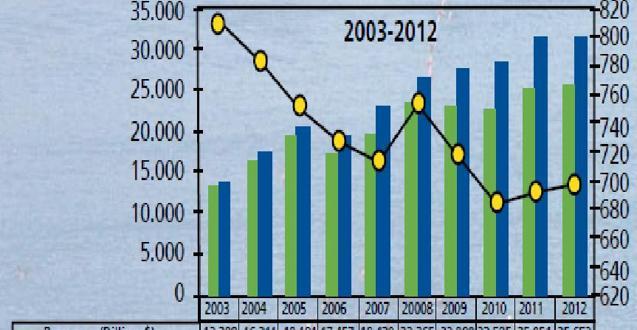

Between 2003-2012, which is the period of the Justice and Development Party (AKP) government, tourism had the biggest share in service exports and 205 billion dollars of income was obtained from tourism. When foreign travel expenditures (including pilgrimage travels) remained at $37 billion, net foreign currency contribution of tourism became 168 billion dollars. It is important to obtain $700 of foreign currency income per visitor, whose total number was about 32 million at the end of 2012.

Foreign currency in construction and transportation

Construction is another sector creating net foreign currency along with tourism. Turkey obtains net foreign currency income from construction activities in Russia and other CIS countries, North Africa, Balkans, and the Middle East; though they are not very large amounts. Also, the expenses seem to be zero in this sector. However, the foreign currency income annually obtained in this sector does not even reach $1 billion. It is commonly accepted that the sector keeps a part of its currencies abroad.

Another sector bringing foreign currency is transportation, though it does not enable much gain. There is a huge opportunity for foreign exchange saving in this sector, but it cannot be used. In freight shipment, Turkey is in the position of a net foreign currency payer. In civil aviation; however, it is a foreign currency earner. Particularly in import activities, with the imposition of the contract, the delivery of goods are made by a transportation company the importer firm wants. As a result, the transportation service is provided not by domestic capacity but foreign firms, which leads spending foreign currency. As the enlarged flying units of the Turkish Airlines in private flying increased the share of international flight incomes in the total endorsement, a gain of foreign currency income was created. But still, it is debatable whether it is enough to make Turkish Airlines a profit-making company.

The net foreign exchange income obtained in transportation over the last decade is $8 billion in total, which corresponds to $800 million of annual income.

Services with deficit

In Turkey, banking and insurance systems also have some investments abroad. The banks purchased or established abroad, the branches opened abroad… However, while about $9 billion of foreign exchange income was obtained from these activities within the last decade, above $16 billion of foreign currency was spent on finance and insurance services in return; and about $7 billion of foreign exchange gap was formed in this sub-branch within this decade.

Turkey is also at a loss in service exports and imports of the state. The state seems to have spent over $13 billion of foreign currency for services such as consultation, education and know-how that were purchased from abroad over the last decade. As the income obtained from services that were mostly sold to other Turkic states and neighboring countries remained at about $4 billion, $9 billion of deficit emerged in this category, as well.

The foreign exchange incomes of private hospitals, foreign student incomes of foundation universities, incomes obtained from footballer transfers, the exported TV series, movies and authors royalties etc… The total foreign exchange income obtained by education, health, and service sectors were not enough to meet the foreign currency spending made again for these sectors. Within the last decade, Turkey had above $5 billion of deficit only in “other services” group in total.

Just as in the competition for industrial product exports, you become the market in service products if your competitiveness is not high and you cannot use your advantages efficiently in service product sales. When tourism is set aside, Turkey is a country which hardly compensates its expenditures with the income obtained from services. Except the construction and transportation sectors, it is a net service importer. In the service sector, can Turkey regain the competitiveness it lost in exports? We will see in the following years.