A monetary policy column bound to confuse

At first look, the Central Bank of Turkey’s rate-setting decision on Nov. 19 contained no surprises. As expected, the Bank did not change any of its interest rates.

At first look, the Central Bank of Turkey’s rate-setting decision on Nov. 19 contained no surprises. As expected, the Bank did not change any of its interest rates.However, it has recently managed to surprise more than any other central bank, and it did not disappoint this time, either. As soon as I opened the one-pager accompanying the rate decision, I felt something was missing. It turned out that the parenthesis next to the one-week repo rate, clarifying that it was the policy rate, had disappeared. That’s how the Bank ditched its long-term policy rate.

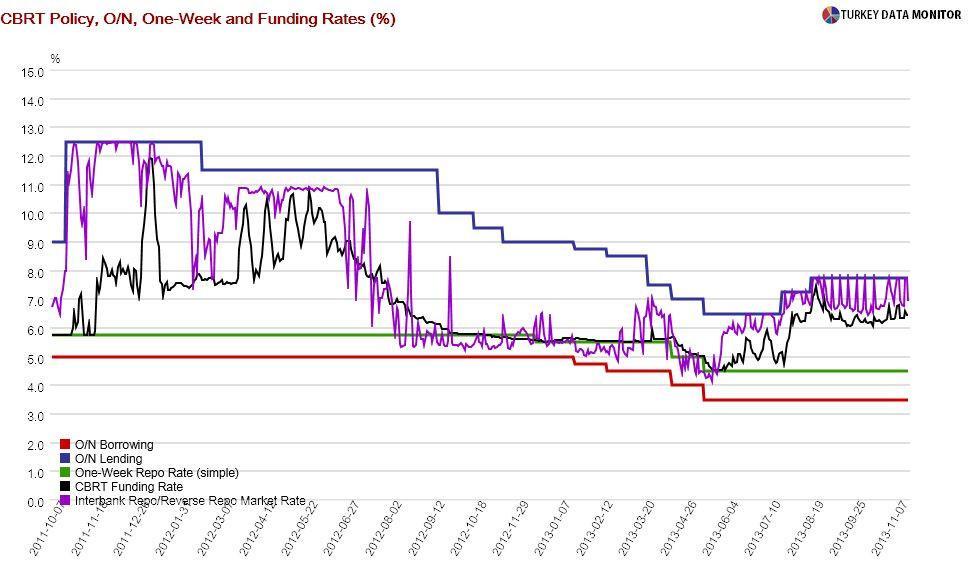

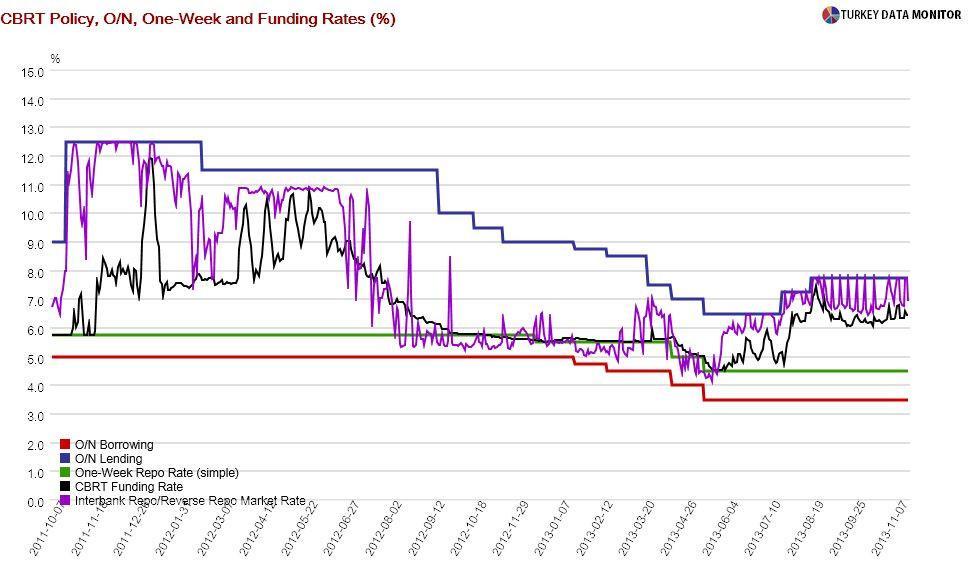

As the one-week repo had stopped being the policy rate for quite a while, the decision makes sense from a practical point of view. But the Bank failed to announce a new policy rate. When repeatedly asked about this during the Bank’s regular meeting with economists on Nov. 20, Deputy Governor Turalay Kenç reluctantly deemed the interbank money market rate as the new policy rate.

That decision makes sense as well. After all, the Bank had brought that rate to the spotlight in the one-pager by terminating one-month repo auctions and pledging to keep the interbank money market rate at around 7.75 percent. This rate was hovering around 7 percent, except in additional monetary tightening (AMT) days when it would jump to 7.75 percent, with the Bank funding even primary dealers at 7.75 percent.

In other words, there would be no need for AMT, as Kenç emphasized during the economists’ meeting. But then the Bank announced on Nov. 21 that it would be holding AMT on Nov. 28, as well as the last business days in December and January. The Bank had previously announced that it would increase predictability from one week to one month. Özlem Derici of Ekpres Invest thinks this new measure “seems to serve this commitment.”

While markets and economists reacted positively to the rate decision, which they saw as tightening, the interbank money market rate will not hit 7.75 percent unless the Bank stops funding markets via the cheaper (4.5 percent) one-week repo. Even if they did, primary dealers would still be able to borrow from the Bank at 6.75 percent, keeping the interbank below 7.75 percent.

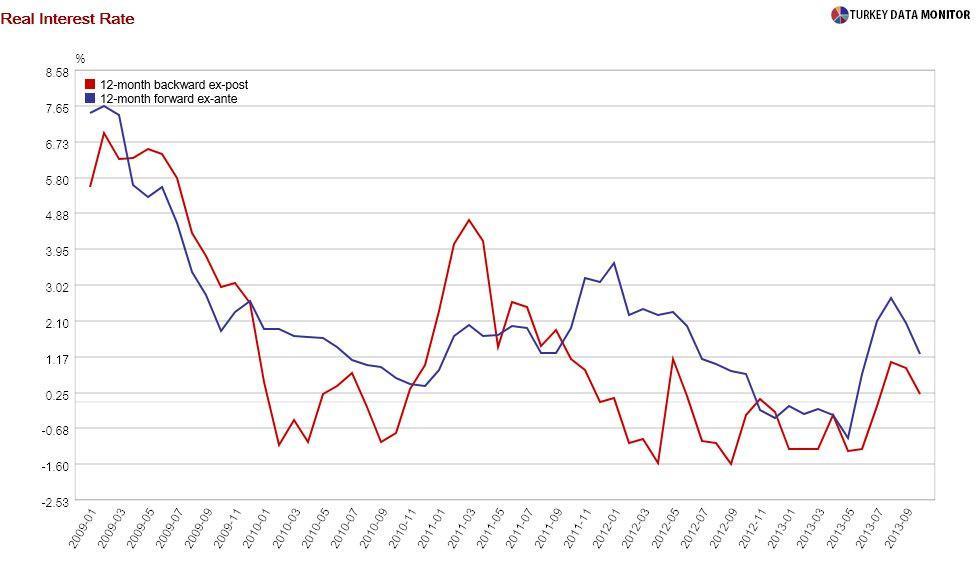

I am also not sure if even 7.75 percent is tight enough. After all, actual or expected inflation yields a real interest rate between 0 and 1 percent. Academic studies calculate Turkey’s neutral real interest rate, the rate that is neither contractionary nor expansionary, to be at least 2-3 percent. By this measure, Turkish monetary policy is still loose.

When an economist made this exact point at the economists’ meeting, Kenç told him to look at market rates (which tell nothing about monetary stance IMHO), while the Bank’s chief economist Hakan Kara referred him to the financial conditions index he had constructed in a paper he published in November 2012. The index itself is not published by the Bank!

Have I managed to confuse you enough? It is really not me, it is the Central Bank. I swear J…