Bigger euro firewall needed before more IMF funds

MEXICO CITY - Agence France-Presse

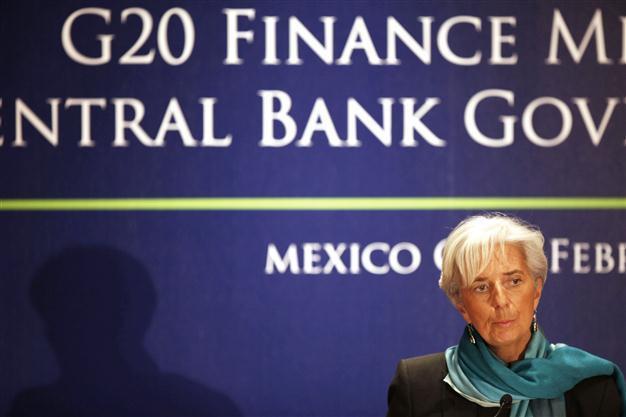

Christine Lagarde, Managing Director of the International Monetary Fund (IMF), attends a news conference at a meeting of finance ministers and central bankers from the Group of 20 top economies in Mexico City February 26, 2012. REUTERS/Edgard Garrido

The eurozone will have to put in place a bigger financial firewall to combat the crisis before other countries will pour more cash into the IMF, the G20 top and developing economies said yesterday.In a statement released after a meeting of the group of 20 finance ministers and central bankers here, the G20 said: "Euro area countries will reassess the strength of their support facilities in March.

"This will provide an essential input in our ongoing consideration to mobilize resources to the IMF." Calls on the eurozone to boost their crisis-fighting war chest dominated the meeting here in Mexico City, with top officials such as US Treasury Secretary Timothy Geithner saying it was essential to prevent more fallout worldwide.

At a crunch two-day summit in Brussels starting on Thursday, EU leaders will debate whether to combine their current firewall, the EFSF, with a permanent pot due to come into effect in July.

This would give the debt-wracked 17-nation zone a total fund of some 750 billion euros ($1 trillion).

To add even more firepower, the eurozone has called on countries outside the bloc to bolster the IMF resources. IMF chief Christine Lagarde has said the fund needs an additional $500 billion.

"Progress on this strategy will be reviewed at the next minister meeting in April," the statement said.

Eurozone countries themselves have already committed 150 billion euros to the IMF in the hope of reassuring the markets they have the resources to tackle a re-emergence of the crisis.

But countries outside the zone, including the United States, Britain, Japan and China insisted at the G20 meeting here that the eurozone first puts its hand in its pocket.

Britain's Finance Minister George Osborne said a trade-off had to be made.

"We are prepared to consider IMF resources but only once we see the color of the eurozone money and we have not seen the color of the eurozone money," he told Sky News on the sidelines of the meeting.

However, the major sticking point to an increase in the eurozone firewall remained Germany -- the bloc's top economy and political powerhouse.

Finance Minister Wolfgang Schaeuble made no bones of Berlin's opposition to pouring in more cash to the pot, saying it "didn't make any economic sense." Schaeuble also played down the chances of success at the March 1 and 2 summit saying that a decision on a strengthened firewall would be taken "in the course of March," recalling that "March runs from 1 to 31." Nevertheless, he also noted that a decision in March would be "timely" given the IMF discussion on more resources a month later.

A senior G20 official said that Europe was carefully managing the sequence of steps needed to put in place all the building blocks for a total deal -- bigger eurozone fund plus more IMF funds -- that would finally douse the crisis.

And while piling on the pressure on Europe to sort out its problems, the G20 statement also heaped praised on policymakers for the measures already carried out, notably in crafting a second bailout package for recession-mired Greece.

"We welcome the important progress made by Europe in recent months to strengthen their fiscal positions, adopt measures to reduce financial stress... and to put Greece on a sustainable path," the statement said.

Nevertheless, while the crisis has abated in recent weeks, the G20 warned that "growth expectations for 2012 are moderate and downside risks continue to be high." The statement said the top economies were "alert to the risks of higher oil prices and welcome the commitment by producing countries to continue to ensure adequate supply."